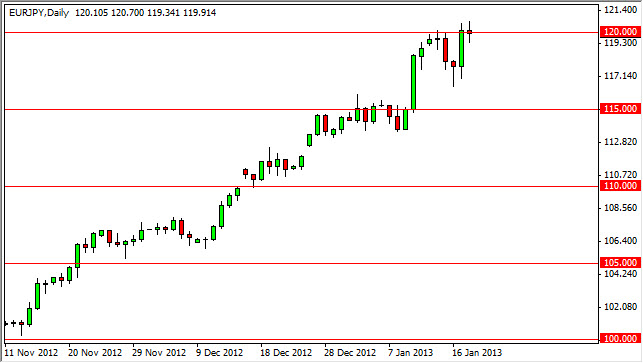

The EUR/JPY pair has been out-of-control and absolutely ridiculous for the last couple of months. The way this pair moves, you would be forgiven if you thought gravity failed to exist. Having said that, we have seen a nice and relentless uptrend and it's obvious at this point time selling this pair is a very dangerous proposition.

The Friday candle wasn't much to look at, unless you think about it within the context that it's been printed. We are at the 120 handle after the surge on Thursday, and the market simply refuses to budge. On top of that, the weekly candle is a wicked looking hammer that suggests that we are going much higher. If you have been waiting for the pullback in this pair, more than likely you've been waiting empty-handed.

On Tuesday, we will have a meeting and press conference out of the Bank of Japan, and this could be setting up to be a "sell on the news" type of move. After all, we have absolutely exploded to the upside in the expectations for the Bank of Japan to expand its quantitative

easing has been obvious, and probably overinflated. Although I firmly believe that this pair will continue higher over the long run, I'm actually hoping to see some type of knee-jerk reaction of disappointment in the marketplace as the bullish close out their bets.

Pullbacks are gifts

Every time this pair pulls back, the first thing that you should be thinking is where you want to be entering the market. After all, this type of parabolic move is very rarely a mistake, and almost never fails to get follow-through. However, the pullbacks could be relatively steep it times as the move has been so one way, so waiting for some type of at least daily supportive candle is probably can be the way to go. You'll notice on this chart that I have plotted every 500 pips. Looking at it, you can see that the markets are definitely following a very symmetrical pattern, so as a result I am more than willing to buy supportive candles after pullbacks at any one of the red lines on the chart.