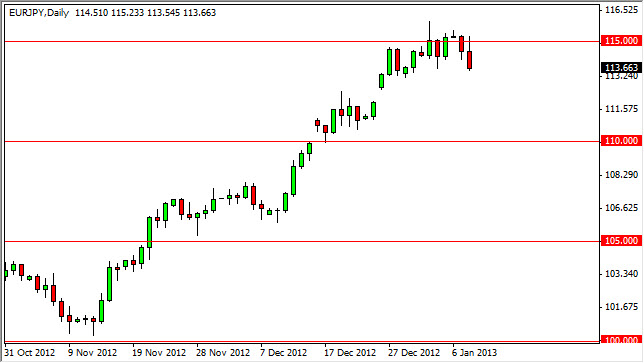

The EUR/JPY pair originally trying to break above the 115 level during the Tuesday session, but we solve this pair fall as the day wore on. I believe that we are getting close to see in this pair pullback to the 112 level, an area that was a massive gap from two weeks ago. This is common in the world of technical analysis, as gaps tend to get filled.

I believe that buying this pair somewhere between 110 and 112 will be one of the better trades over the next couple of months. The pair has been shooting straight up, and this pullback will be welcomed. I believe that the 200 pip area should be a massive support area that should have buyers stepping into the market once we get down there.

With the Bank of Japan getting ready to start actively working against the value of the Yen, and the Euro getting a bit of a reprieve against most currencies, this is essentially the" perfect" trade at the moment. Nonetheless, we have seen a far too strong of a move in a short period of time, and a pullback is absolutely vital at this point.

The Euro on sale

As this pair pulls back, it is essentially the same thing as the Euro being on sale. If you can buy it for as little as ¥110, this could be one of the better values out there in the Forex world right now. We certainly see this is a one-way trade, and believe that in the long run this pair will go much, much higher. There will be pullbacks from time to time, but these are simply going to be opportunities to buy the Euro cheaper. This is essentially the essence of Forex trading, buying a strong currency cheaply.

There is a possible sideways consolidation area that we are in right now, but I believe that we need to pullback in order to get a lot of traders excited about going long again. With all that being said, I will be very patient, but willing to buy any type of hammer, fairly decent size green candle, or various other bullish candlestick patterns somewhere below where we are trading at presently.