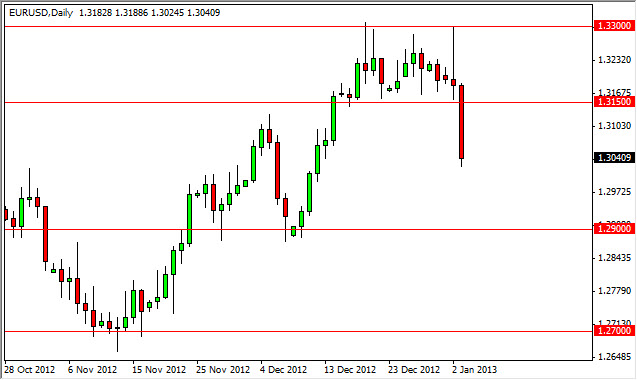

The EUR/USD pair fell rather precipitously during the Thursday session after forming the shooting star for Wednesday. I had suggested previously that this could be a signal of things to come, and this appears to be exactly what has happened. The 1.31 handle was the bottom of the support area as far as I can tell, and as a result there can be no doubt now that support has been broken.

Going forward, we of course have to pay attention to the fact that today is nonfarm payroll Friday, which generally makes for would be in choppy conditions to say the least. Because of this, I wouldn't recommend jumping into the markets today as the price action will be very erratic to say the least. If you are already in the trade, that's one thing. However, if you're looking to enter during the nonfarm payroll circus, you're looking to get yourself heard.

Continuation?

I believe that we will see continuation for several different reasons. For one, I believe that we could see a poor jobs number, which is traditionally toxic for this currency pair. It becomes a "risk off" trade, and you can see this pair fall rather drastically. However, even if we get strong numbers there is the possibility that people flooding back into the United States as Europe looks ready to fall into a recession, while the US bond market should be offering higher yields soon.

The Federal Reserve released its minutes during the session on Thursday, and this is exactly why yields will begin to rise soon. The minutes suggested that the board of voting members is starting to see a bit of a shift in attitude as more of them look at further quantitative easing as simply unnecessary or at least ineffective. If that's the case, we should see bond yields in the United States start to rise slightly, and that will attract more capital into the country. In that circumstance, the Dollar will continue to strengthen as traders flood the bond markets going forward. As far as buying this pair, I don't think that would be the way to go. However, I think any rally could give a nice sell signal right around the 1.3150 area as it should be resistance now.