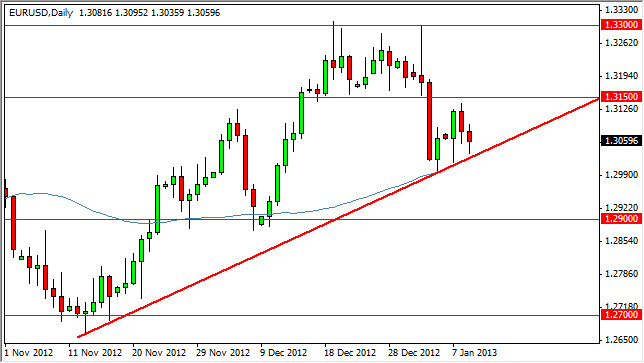

The EUR/USD pair fell during the session on Wednesday, but has hit an interesting area that is causing a bit of confusion for traders out there. For starters, we have an uptrend line that is now looking more and more supportive, and the action on Wednesday would have done nothing to dissuade traders from believing in the validity of this trend line.

I think that we are going to enter extremely volatile trading conditions here in the short-term. Because of the hammer that has been formed for the session, I think that there is an obvious bias to the upside, but we have the 1.3150 level above that was so massively supportive previously. This typically should turn into resistance going forward; we have already failed that area once. If we managed to get above the 1.3150 handle, I think that the resistance between there and the 1.33 level will more than likely offer some type of resistant candle to start selling again.

50 day EMA

Adding to the bullish case is the fact that the 50 day EMA is just below as well, and this will of course have some traders involved from the long side just for that reason alone. I think that the obvious spot on this chart we to be the trend line or the 1.33 level. If we managed to break below the bottom of the hammer from the Wednesday session, this would not only be pulling out the support from the session, but also the trend line. If that happens, I suspect that we will see 1.29 in relatively short order.

Alternately, if we do get a bit of a boost I believe that will be relatively short-lived. If we do manage to somehow get above 1.33, you would have to think that the pair was going to go much, much higher over the long run. This pair has been the bane of many traders existence over the last couple of years, simply because we keep going back and forth between focusing on problems in Europe, and then focusing on problems in the United States. Quite honestly, both economies have major issues and it will continue to make this a very headline driven currency pair.