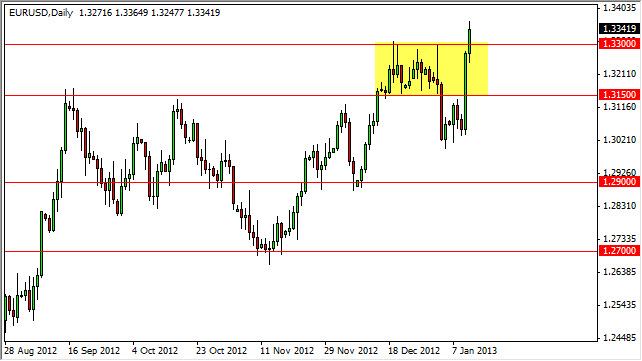

The EUR/USD pair smashed through the 1.33 resistance level on Friday as the uptrend continues. Obviously, we have broken out and the fundamental outlook for this currency pair has completely changed. After the comments by European Central Bank Chairman Mario Draghi, the Euro will suddenly become favored or at least revalued as so many of the market participants expected rate cuts out of the European Union.

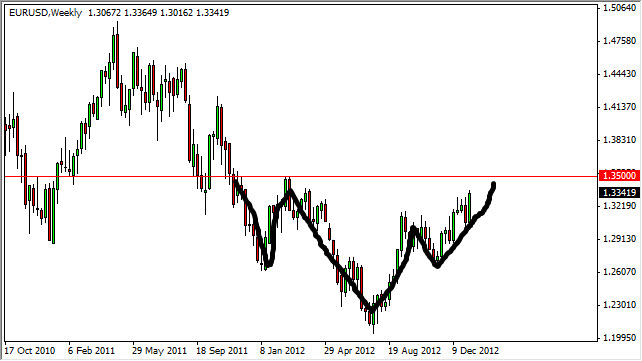

Now that rate cuts seem to be off of the table, it's very possible that we will start to see the Euro strengthen overall for the long run. In fact, when you look at the chart from a longer-term perspective, the 1.35 level is absolutely crucial when it comes to the future direction of this pair. Currently, I see the 1.35 level as the next stop for the buyers.

However, something much more important is going on at that level. Because of this, I am including to charts with this article as it is so vital.

Inverse head and shoulders

When you look at the longer-term chart, and especially on the weekly one, you can see that the 1.35 level would be the neckline of a massive inverted head and shoulders. By taking standard technical analysis measurements, if we managed to close above the 1.35 level on a daily chart, is very possible that this could be the beginning of another leg higher. Based upon the measurements of that inverted head and shoulders, we could be seeing a move all the way to 1.50 before it’s said and done. I know this sounds a bit radical at the moment, but you have to remember that for several years this pair was a simple as buying it every time it dips. Could we possibly be heading back of those types of markets? If so, Forex will suddenly become very simple.

With this being said, I believe in the short-term the Euro is a buy on pullbacks as long as we don't slip back below the 1.32 level. As long as that doesn't happen, I will be buying the pullbacks every time we show support on the short-term charts. I believe that eventually we will breakout, and with that move we will start to see a nice multiyear trend.