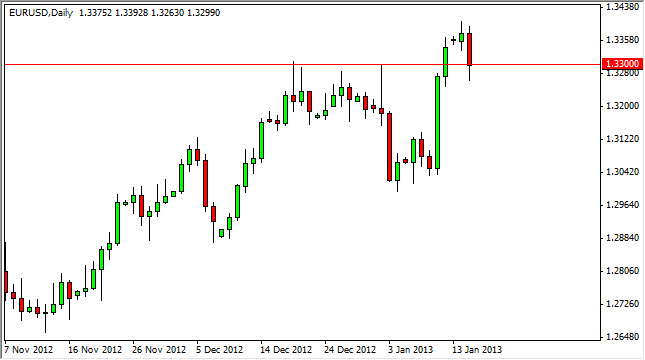

The EUR/USD pair pulled back during the Tuesday session in order to test the 1.33 level for support. The pair even managed to fall just above the 1.3250 area, but bounced towards the end of the day in order to show that support did in fact reside in that general vicinity.

We have broken out above the 1.33 level over the last couple of days, and a pullback to that area to prove it as resistance turning into support isn't exactly a stretch of imagination. In fact, it would be expected, and a lot of buyers will be willing to step in the marketplace now that we have pullback. Because of this, I'm getting bullish of this pair again. However, I should state that I hate this pair and aren’t as bullish about it as many other ones. After all, most of the traders I know have been chopped up in this pair of the last couple of years, as there is no discernible trend in times.

We finally have a trend?

With the European Central Bank finally stating that there was nothing wrong with the European economy and there was nothing it needed to do as far as monetary policy, traders finally got the green light to start buying the Euro as ECB is not going to raise rates anytime soon. Whether this is true or not depends on what you define as a "normal economy", which may or may not include a Portuguese economy that has a 25% unemployment rate. Just saying…

Having said all that, the markets will do what the markets will do and therefore we must acknowledge the fact that the Euro is in favor again. This is a simple interest-rate play as the Federal Reserve looks to keep zero interest rates until the end of time. With that being said, this does have the look of a market that could become a "one-way trade." In all seriousness, I will admit that if we break above the 1.35 level, it would be the confirmation of an inverted head and shoulders on the long term charts that would have a target of 1.50 in the end. As crazy as this sounds, it could very well be true.