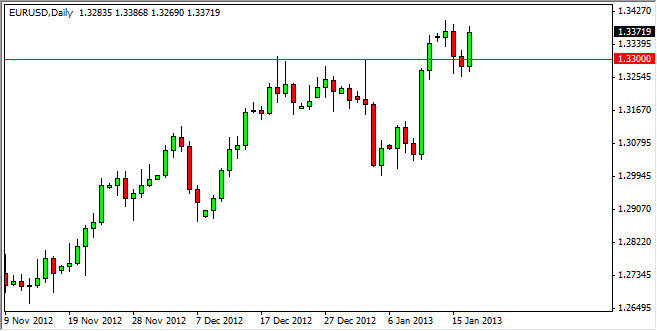

The EUR/USD pair had another strong showing on Thursday as the bulls continue to push the markets up and away. The Euro has been enjoying a bit of a reprieve from the brutal selloff we saw for most of the previous year or so, and as a result there has been quite a bit of short selling.

However, we are now seeing significant breakouts. The 1.33 level is a fairly strong one, and it appears that we are going to try the 1.35 level before too long. This area is a massively important one in my opinion, as the market will have completed an inverted head and shoulders, and one that measures for a move all the way to 1.50! Because of this, I think that the Euro is going to astound us all, and continue to move relentlessly in a bullish direction for most of 2013.

Of course, this all hinges on breaking out of 1.35, but there is nothing over the last couple months that would make me think you can't do that. The fact that we bounced off of the 1.33 after originally breaking out of it to the upside suggests that "what was once the ceiling has now become the floor." This is basic technical analysis, and as a result most of the trading world would recognize that this is a breakout waiting to happen.

Buying the pullbacks

At this point time, it appears that buying the pullbacks will be the only way to play the Euro. The currency has done well against most other currencies around the world, and the US dollar is only one example. The Euro is beating up the British pound, the Japanese yen, and many other currencies simultaneously. This is obviously a pro-Euro move, and as a result I believe that we will see much higher prices.

The European Central Bank has stated recently that it has no plans on cutting interest-rate, and this of course is what really got things moving in the Euro’s favor. While we were bullish before, we are now wildly bullish.