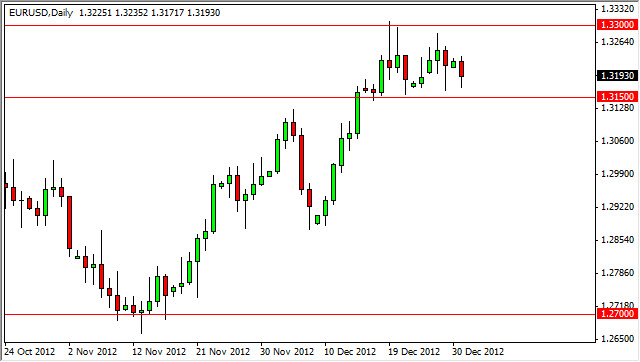

The EUR/USD pair is just about enough to make me fall asleep. This pair has been stuck in a relatively tight range recently, the question now is whether or not it is simply taking a rest before goes higher, or starting to run into significant resistance and about to turn lower.

As you can see by this daily chart, the 1.33 level has offered significant resistance. On the downside, you can see that there is significant support at 1.3150, and I feel that the support zone actually extends down to the 1.31 handle as well. Because of this, I think that it will take something significant to break this pair down, but we could see several different things, helped to push a "risk off" move into the marketplace is in general. Certainly, this currency pair would not be immune to some type of fiscal shock coming out of Washington DC during these talks.

"Risk on" rally, yet the Euro sits still

For me, one of the most telling signs that the Euro could be in trouble is the fact that we have a massive "risk on" rally during the day, yet the Euro could not move higher. In fact, it finished the day lower unlike its next-door neighbor the British pound. If you look over at the EUR/GBP pair, you can see that it absolutely collapsed during the session. This would have me very concerned about the Euro in general. After all, on a day where rumors came about that suggested that the Congress is getting closer to signing some type of deal, it would make sense of the Euro would go higher as a result. However, this did not happen.

For the time being, I think we will continue to bounce around between 1.3150 and 1.33 or so. Because of this, I think that it is a short-term traders market, and will more than likely be best played off of the 15 minute chart or something of that type. Until we break out of this range, I just simply do not see a media more long-term trade happening.