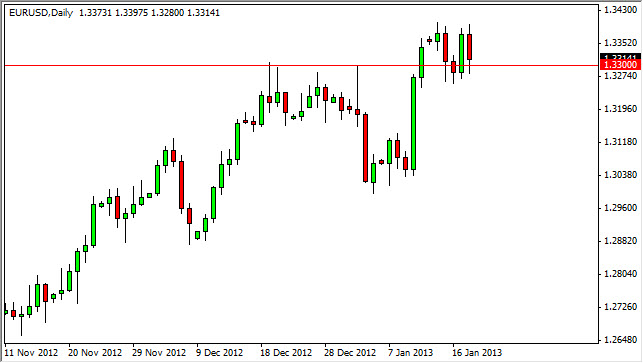

The EUR/USD pair lost ground on Friday as we continue to bounce around just above the 1.3300 level. This area of course was significant resistance previously, and as a result we are currently testing it out support. This is a basic tenet of technical analysis, so of course this move isn't necessarily surprising.

Looking at the breakout was indeed fairly significant, and the fact that we managed to clear that area and instead of pulling back have simply gone sideways does suggest that there isn't much in the way of fear when it comes to holding the Euro. Because of this, I think that we are eventually going to go higher, but we could get pushed around a little bit as this pair has become very choppy overall.

There are a lot of different catalysts out there that can move this pair, not the least of which of course is general risk appetite around the world. As a general rule, the US dollar will lose value as people feel better about the economies globally, and as a result this pair would go up. The biggest problem right now is there simply one headline after another that we are dealing with, and we don't know exactly what the world would choose to focus on Europe again instead of the United States.

1.3250

I am currently long this currency pair, and will remain so until we get a daily close below the 1.3250 level. It's down there that I see the real support, and as a result I think that we will continue to pop in and out of the 1.33 handle. However, there should be plenty of things out there that could move this market higher, after all we have three different central banks making statements this week, and of course the stock markets can also help moving along as well. After all, we are in the middle of earnings season in the United States, and that is a big mover of currencies sometimes.

All things being equal, I do believe that we will make an attempt at the 1.35 level, and if we do get above that we will have broken a significant technical barrier. In fact, when you look at the longer-term charts it appears that there is a bit of a head and shoulders pattern forming, and if that's the case measuring the move gives us all the way to 1.50 before its said and done. It's hard to believe, but quite frankly we been there before so why would be that exciting?