The EUR/USD pair did almost nothing during the Monday session, as would be expected as the United States was celebrating Martin Luther King Jr.'s birthday. Because of this, the markets are very illiquid, and we saw almost nothing out of Forex markets during North American hours. Also, it should be noted that the Bank of Japan is having a massive announcement early Tuesday morning and Asia, and as a result a lot of traders simply would not have wanted to take on any additional risk at this point.

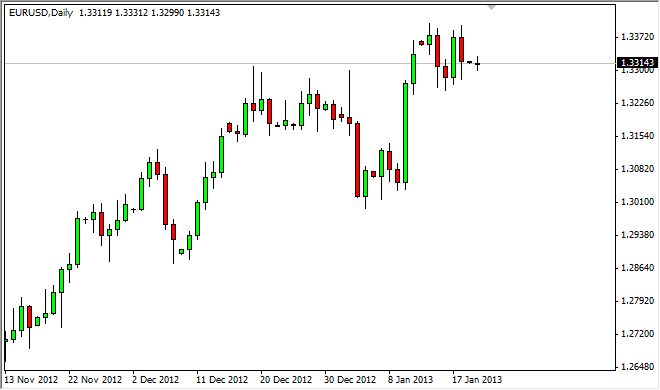

Looking at this chart though, it's easy to see that we are in consolidation between the 1.33 level and the 1.34 level. With that in mind, I am more than willing to play this market from the short term standpoint. I think that the short term charts will offer plenty of signals for those of you who are more into scalping than longer-term trades. Trading this type of environment is relatively simple after all, as you simply buy at the bottom (1.33), and sell at the top (1.34). Sooner or later, you will break out of the range, and you simply follow the market in that direction.

Choppiness ahead

Even though I believe we will eventually break out, I still believe that there will be a lot of choppiness going forward. This is mainly because I believe we're better breakout to the upside, which of course means we have to chew through the 1.34 level and try and breakout above the 1.35 level. This of course will take a significant amount of bullishness, but I think the markets are essentially conditioned to buy the Euro over time anyways.

If we can get above the 1.35 level, it looks like we have broken the neckline of an inverted head and shoulders. If that's true, measuring that consolidation area gives us a target of 1.50! Needless to say, we've been there before so it's not that big of a deal - but it certainly would be the beginning of a very nice move. If that's the case, it's possible that we may see this pair acting very much like you did five years ago before the financial crisis. Back then, you simply bought the Euro on every pullback.