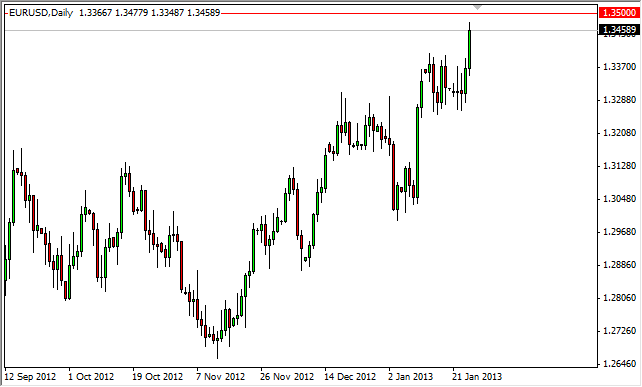

The EUR/USD pair had another bullish session on Friday, as the buyers continue to take control in this market. What I find interesting is that we are currently testing the 1.35 level, and although we didn't break above that we certainly close on a high note for the week.

This pair is currently testing one of the most important spots on the chart. If you look at the longer-term charts, you can see that the 1.20 level is massive support, while the 1.50 level is massive resistance. In a way, you can make a case for it being one big massive consolidation area. Because of this, there is normally a "middle point" that a lot of traders will pay attention to. Halfway between 1.20 and 1.50 is the 1.35 level.

Looking at the same long term charts, you can see that we are presently forming an inverted head and shoulders pattern. The neckline is of the 1.35 level, and this of course measures down to the 1.20 level. This 15 handle pattern suggests that we are going out to the 1.50 level, or simply returning to the top of this massive consolidation pattern.

Return to normalcy?

When I first started trading Forex about six years ago, one of the easiest trades was to simply buy this pair every time it dipped. For its use actually be a fairly easy endeavor, as trends would run forever. We are starting to see a lot of the old correlations come back, and as a result this is one of the pair is that people will hover towards in the future.

I firmly believe that if we break this 1.35 level, we will return to the old days of "buying on the dips." Because of this, I firmly hope this happens, as it will make much easier trading going forward. It's great to finally have a currency that you are "allowed" to own, based upon recent comments out of the ECB that they feel no reason to implement new monetary policy with the Euro at these levels. In a world where most central banks are trying to kill off their own currencies, this gives a massive green light for the bullish to get involved.