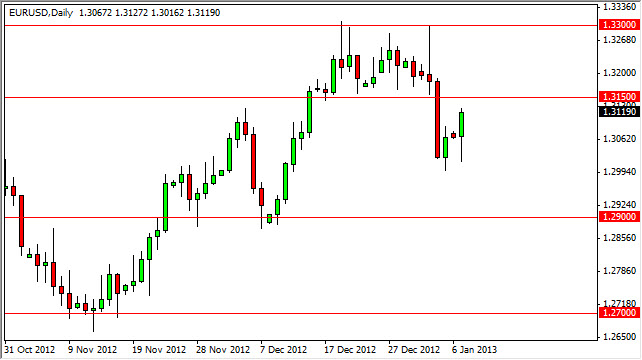

The EUR/USD pair initially fell during the Monday session, but we got a bit of support at the 1.30 handle in order to push the market higher. At the end of the day, we closed above the 1.31 handle, and formed what looks a bit like a hammer, suggesting serious bullish strength underneath.

Looking at the charts though, I can see that the 1.3150 level should be rather resistive. After all, it was support just a few sessions ago, and breaking below it was indeed a significant event. I don't know whether or not we can get above it, or more importantly hold the gains once we do. I do know however that there is quite a bit of resistance all the way from 1.3150 to the 1.33 handle, and this does without a doubt look like a good way to lose money to me. After all, if I will by the Euro, there are easier currencies to buy it against. (Hello Yen and Pound.)

Thick resistance zone

I have learned over the years that these thick resistance zones tend to be very difficult to chew through. It's not that they can't be, but I have learned that quite often you will get a surge higher, only to see the candle failed by the end of the session and the next thing you know, you have a shooting star forming in the middle of it. I think there is a very high chance of this happening.

Nonetheless, if we can manage close above the 1.33 level I wouldn't hesitate to start buying the Euro at that point. There is quite a bit of messiness all the way up to the 1.35 handle though, so it won't necessarily be the easiest market to start buying the Euro and even once we break out. All this being said, I think that selling this market on a resistive and weak looking candle just above could be the way to go. This will more than likely show itself in other EUR related pairs, so keep an eye on how the currency does in general.