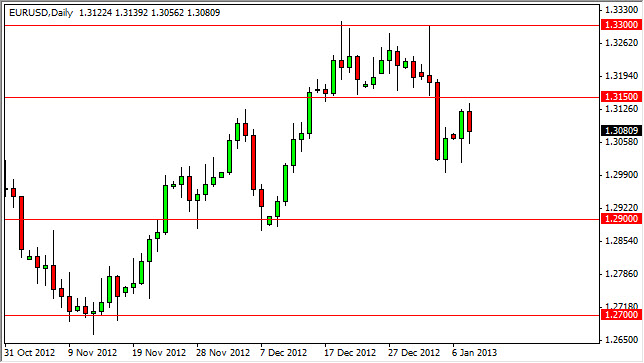

The EUR/USD pair attempted to rally during the session on Tuesday, but found the 1.3150 level too resistive to overcome. This was once the site of a massive support, and as a result should continue to be massive resistance. However, I do see a bit of a "spring" in this marketplace as the lows are starting get higher again. Because of this, I do think that there will be continued pressure to the upside, although I don't necessarily expect it to be enough to break out higher.

I believe that we will eventually break above the 1.3150 level, and if we do it should be an excellent opportunity start selling the Euro. There are a lot of headline risks out there currently, and as a result I think this market will more than likely fall over the next several sessions. After all, the debt ceiling limit talks are about to start in the United States, and this could put a real "risk off" type of field to the markets. Also, there are the problems in Europe that are currently being ignored.

Once we get above the 1.3150 level, I do think that we will see massive resistive action come into play and will be selling somewhere in the middle of this zone all the way up to the 1.33 level. I would use a short-term charts in order to start selling as I believe the risk to reward ratio is probably still pretty good.

1.33 is crucial

I believe that the 1.33 level will be crucial for the buyers. If we can break above that level, this pair will have definitely broken out, and there will be no denying the bullishness underlying the market. If we see this, I suspect that we will see a long-term sustained move higher in the market, which of course is something that I don't anticipate at this point. However, we trade the charts that we get and this certainly would be one of those deals where you would have to go ahead and hold your nose and start buying.