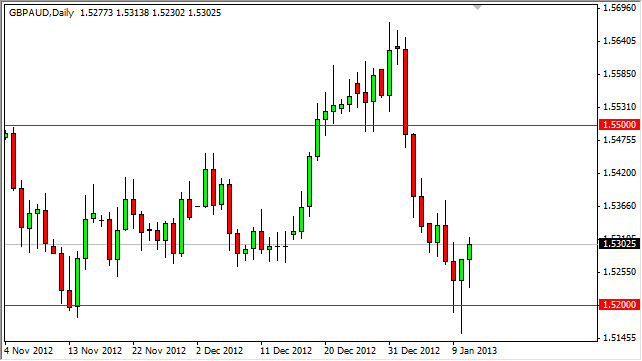

The GBP/AUD pair initially fell during the Friday session, but bounced off of the 1.5250 level in order to climb back above the 1.53 handle. Once impressive about this move isn't the session on Friday by itself, rather it is the third session in a row that has produced either a hammer, or a hammer shaped candle while the Wednesday session isn't technically a hammer, it essentially says the same thing and that is that the 1.52 level is far too cheap for this currency pair.

With this three candle formation, it seems very apparent that the pair wants to climb. Because of this, I will be buying this pair on a break of the highs from the Friday hammer. Granted, I can see that there is a little bit of noise just above, but I feel that this formation a strong enough that it's worth the potential risk.

1.55 Overhead

The 1.55 level above looks like it could be significant resistance, and as such I think that this move may be a simple return to consolidation. It doesn't necessarily mean that I don't like the Australian dollar, in fact I do. However, looking the Australian dollar on the market in general, it does look a little suspect as many of the "risk on" pairs have seen the gains in the "risky" currency, but with the Australian dollar missing out on much of a rally. A perfect example can be found in the AUD/USD pair, which still cannot get above the 1.06 handle.

Because of this, I believe that the Australian dollar is presently looking to pullback in general, and as a result it would make sense of this pair would continue to rise. After all, the British pound formed a hammer against the US dollar on Friday, and this was after a massive green candle on Thursday. It looks like the British pound should continue higher in general, while the Australian dollar may be taking a break. This is also why I believe that we are going to test the 1.55 handle, but not necessarily breakout.