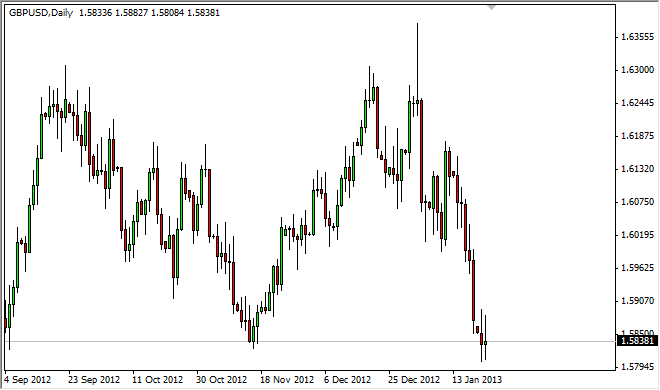

The GBP/USD pair went back and forth during the session on Tuesday, much like the Euro did against the US dollar. However, this pair is sitting on a much more significant support level than the EUR/USD, so it's actually a little bit more interesting to me at this moment.

The 1.58 level just below is the place where we broke out of the ascending triangle last summer that sent this pair much higher. In fact, the pair reached all the way up to the 1.63 level before turning back. Not only did it do that on the breakout, but it actually did it twice. Both times the buyers were pushed back in the markets fell.

The most recent move lower has been far too steep to continue for any significant amount of time. This is why I believe that the 1.58 level has held up so far. Simply put, there's been a rush in one direction, but the volume may not quite be there. In order to break down and below the 1.58 level, this market will more than likely have to balance and collect more sellers.

1.58

I firmly believe that the 1.58 level will hold were at least some time. After all, I see quite a bit of noise below, based upon the ascending triangle that we broke out of last summer. In fact, this may be the beginning of a larger consolidation area between 1.58 and 1.63 going forward. If that's the case, this would be an easy range bound trade to take, on signs of supportive action. So far we have not actually seen supportive candles, but we have seen the market simply sit in one spot.

Looking at the last two candles, I can see that a move above the 1.59 level would be significant enough to perhaps signal a move higher of about 150 pips. If that's the case, we could just as easily go to the top of the consolidation area if we get word out of the Federal Reserve of expansion of its quantitative easing policy for example. With this in mind, I am looking for a bounce at the 1.58 area, or a hammer or some other supportive type of price action.