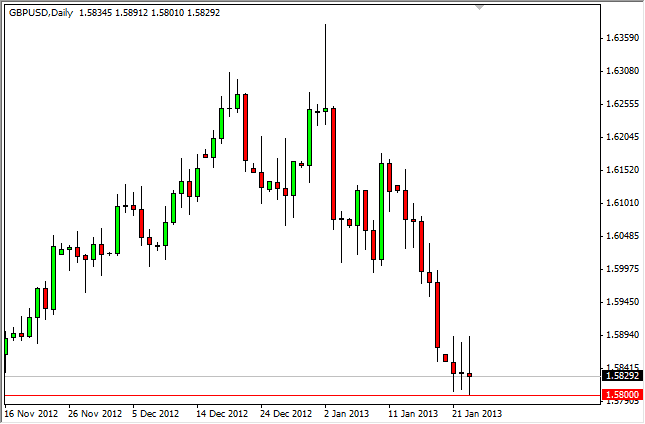

The GBP/USD pair went back and forth during the Wednesday session for the third day in a row. We currently been bouncing on the 1.58 handle, and as a result the area looks like its trying offer a significant amount of support. This is an area that I have found it very interesting, as it was the area that we broke out of to the upside from the ascending triangle over the summer. This triangle sent us all the way up to the 1.63 handle, and of course was important because of that. Having said that, it should be significant support at this point.

Looking at the shape of the three candles in a row, they all suggest confusion or at least resting. It's resting in the sense that we have had a significant fall over the last couple of weeks, now we have to decide whether or not there's any follow through to the selling. I have suspicions that there probably will be a difficult way below for the sellers if they decide to try and push things.

Bank of England

During the Wednesday session, the Bank of England let it be known that they only had one member on the voting committee that suggested further quantitative easing. Because of this, the British pound will have found a little bit of support. After all, many out there thought that the Bank of England was going to have to engage in some type of new quantitative easing.

Adding to the bullishness in the Pound was the fact that employment numbers came out better than expected in the United Kingdom. While we are a long stretch from having to raise interest rates in England, this of course was significant turn of events and certainly puts a bit of firming into the GBP.

On a break of the highs on Wednesday, I would be more than willing to start buying again. That essentially means the 1.59 handle. I currently see this market as bouncing around between 1.58 and 1.59, so I am more than willing to be patient and just take the trade whenever it comes. As far as selling is concerned, although I do see a breakdown of the 1.58 level is relatively significant, I also see a lot of noise below that level. This makes buying the Pound much easier than selling it in my estimation.