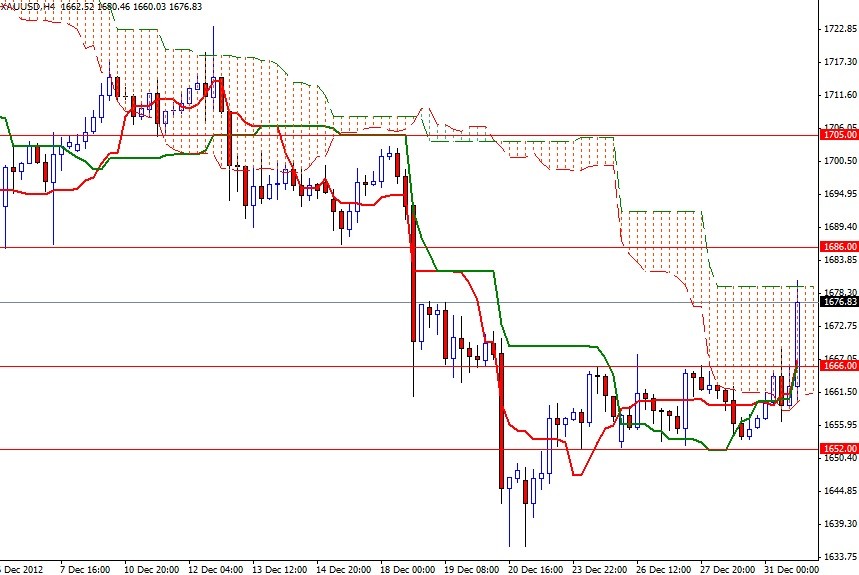

XAU/USD (gold vs. the greenback) ended the final trading day of 2012 higher than opening on growing confidence a deal can be reached in the United States to avoid painful spending cuts and tax hikes which could seriously damage the economic recovery. Although the markets are still concerned that this last minute deal will not resolve the long-term debt problems of the world's biggest economy, the Democrats and Republicans will prevent the United States from slipping into a recession. Also signs that growth in China was gaining momentum supported the precious metal. According to data released by the HSBC, the manufacturing PMI rose to 51.5 from 50.9. XAU/USD traded as high as 1680.46 as investors turned to the relative safety of gold but pulled back slightly. On the 4-hour time frame, we have a bullish Tenkan-sen (nine-period moving average, red line) / Kijun-sen (twenty six-day moving average, green line) cross but the settlement price is just below the Ichimoku cloud. If the bulls can push the pair above Monday’s high, I think we will test the first important resistance at the 1686 level.

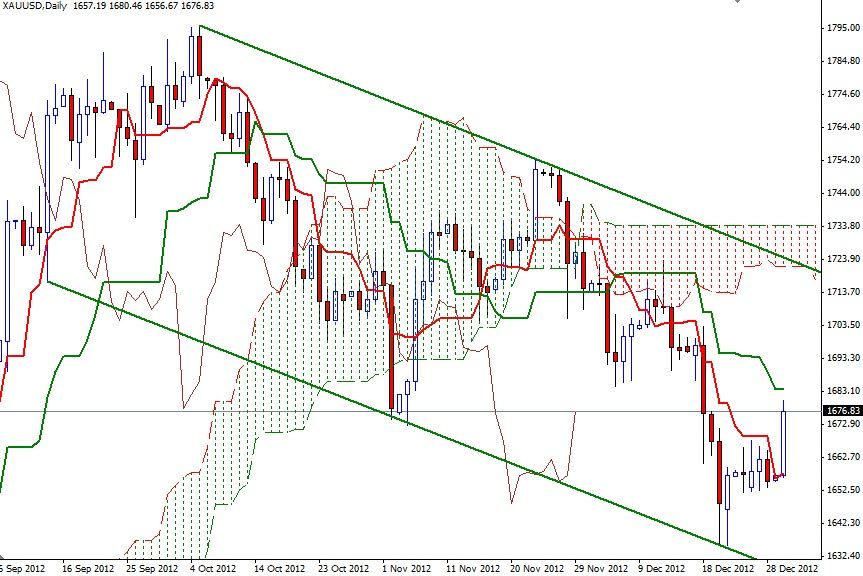

If the pair can hold above that level, then the next target will be the 1700/05 zone. However, until we see a strong catalyst, I believe we will continue to remain in the ascending channel (see the daily chart). If prices turn bearish from here, support will be seen at 1670.50, 1666 and 1658. 1652 will be a key level to watch as it was the bottom of the recent consolidation area.