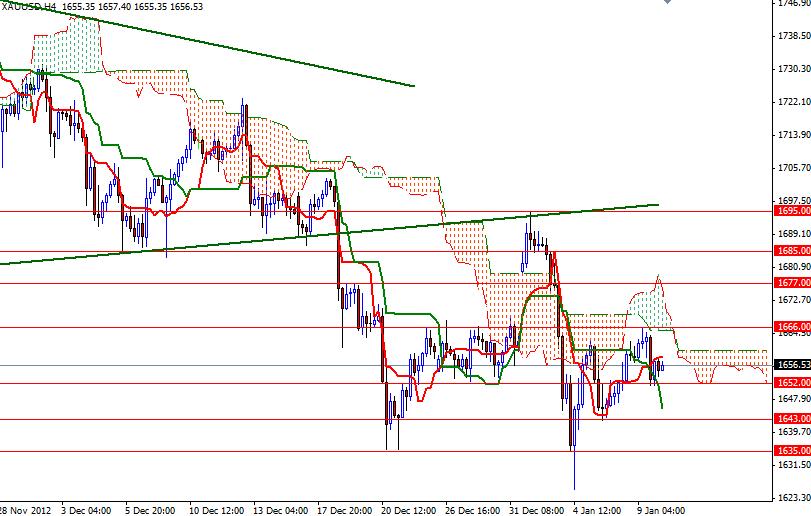

XAU/USD closed slightly lower than opening yesterday but found support at the 1652 level during the Asian session today. The pair rose after the recent data showed that demand for the precious metal increased ahead of the Chinese Lunar New Year which starts next month. However, prices pulled back as the bears increased selling pressure around the 1666 level. Although the increase in seasonal demand is supportive for gold, increasing concern over the Fed policy makers may end $85 billion in monthly bond purchases some time this year is hurting investors’ sentiment. For now, the lack of bullish catalyst leads us to a consolidation between 1652 and 1666.

I think the next major battle between the bulls and bears will come in late February when the debt ceiling will have to be increased. The last time U.S. policy makers went to war over the debt ceiling, the XAU/USD pair had seen a sharp rise over five weeks. In the short term, I am neutral on this pair until we see a clear direction. I think the bulls will need to break above the 1666 level in order to take over. If that is the case, I will be looking for 1677, 1685 and 1695. However, I believe that the downward pressure will increase if the 1652 floor is breached and we will be heading lower. Support to the downside can be found at 1643, 1635 and 1625.