XAU/USD ended yesterday’s session higher, supported by strong Chinese trade balance data and weak demand for the U.S. dollar. The data out of China, the world's biggest gold consumers, showed the country’s trade surplus surged from $19.6 billion to $31.62 billion in December. The data which came out well above expectations eased worries about Chinese growth. US dollar weakness was another factor pushing gold prices higher. The greenback came under pressure after European Central Bank President Mario Draghi said that the ECB’s governing council agreed unanimously to hold interest rates steady at %0.75. The XAU/USD pair managed to break above the 1666 resistance level and climbed to 1678.72 after the data released from the U.S. Department of Labor showed jobless claims rose by 4.000 to a seasonally adjusted 371.000 in the previous week.

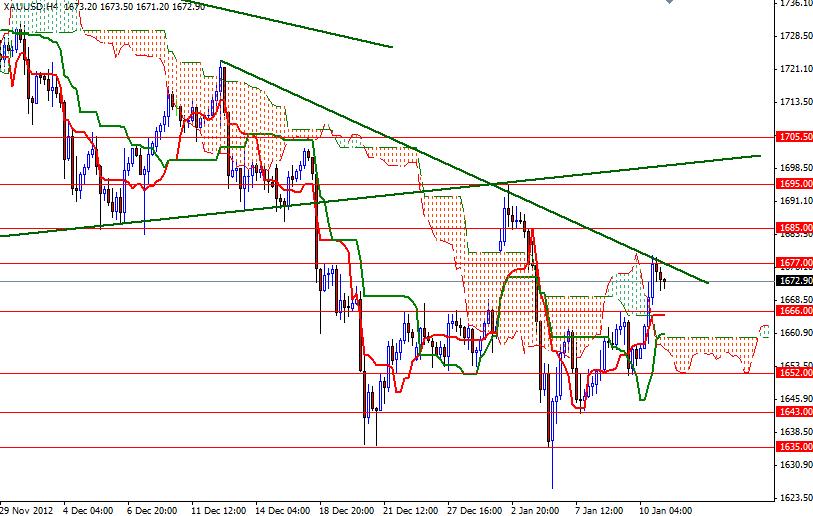

On the 4-hour time frame, the pair is now trading above the Ichimoku cloud and the Tenkan-sen line (nine-period moving average, red line) is moving above the Kijun-sen line (twenty six-day moving average, green line). Although the 4-hour chart turned bullish, we still have a tough resistance at 1677 which also coincides with a descending trend line. I think the bulls will be in control as long as we stay above the 1666 level (the top of the previous consolidation zone). If the pair successfully climbs above the 1677 level, the speculative buying pressure will increase. A break above that level would make me believe that we are heading towards the 1700/05 zone. On its way up, expect to see resistance at 1685 and 1695 levels. However, if we encounter heavy resistance and prices start to fall, support may be found at 1666, 1661 and 1652.