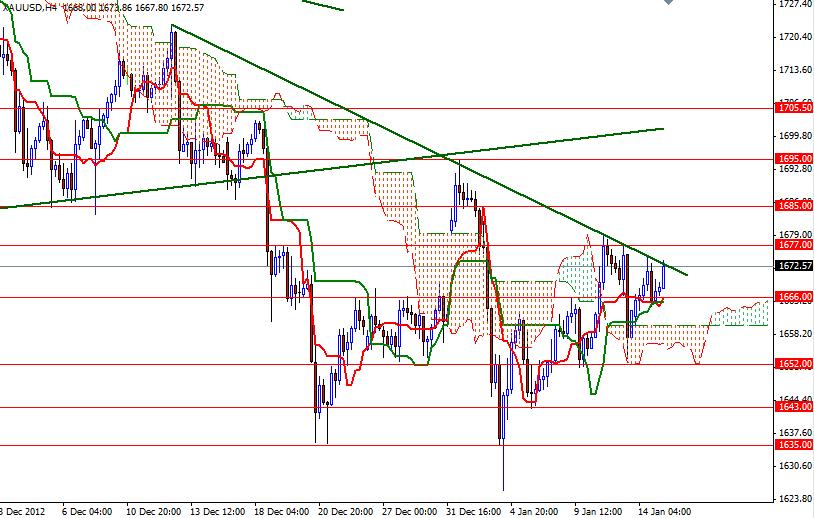

The XAU/USD pair remained slightly bullish yesterday and traded as high as 1674.70. It appears that the bulls gained some strength after Federal Reserve Chairman Ben Bernanke said nothing to reinforce the hawkish reading of the latest FOMC minutes. His focus remained on the labor market and he urged lawmakers to raise the debt ceiling to avoid a default which could be a catastrophe for the recovering economy. While the U.S. runs out of money, President Obama says that he is not going to negotiate on raising the debt ceiling. The Republicans say they are not going to agree to lift the country's borrowing limit unless Obama agrees to reduce the long-term structural budget deficit. Gold prices are still consolidating in the Asian session as we trapped within the Tenkan-sen line (nine-period moving average, red line) and the Kijun-sen line (twenty six-day moving average, green line) on the daily time frame. At the moment, the bulls are trying to break the descending trend line originating in December but there is another strong resistance ahead of us at 1677. The buyers have been struggling to get above this level for the last 3 sessions. Although the 4-hour chart suggests there is a chance we will see the pair trading higher, the daily chart remains bearish.

Today I will be watching the 1677 and 1666 levels. If the bulls manage to push the pair above 1677, look for 1685, 1695 and 1700. But if we fail to break higher and prices reverse, there is a good chance we will encounter some support at 1652, 1643 and 1635.