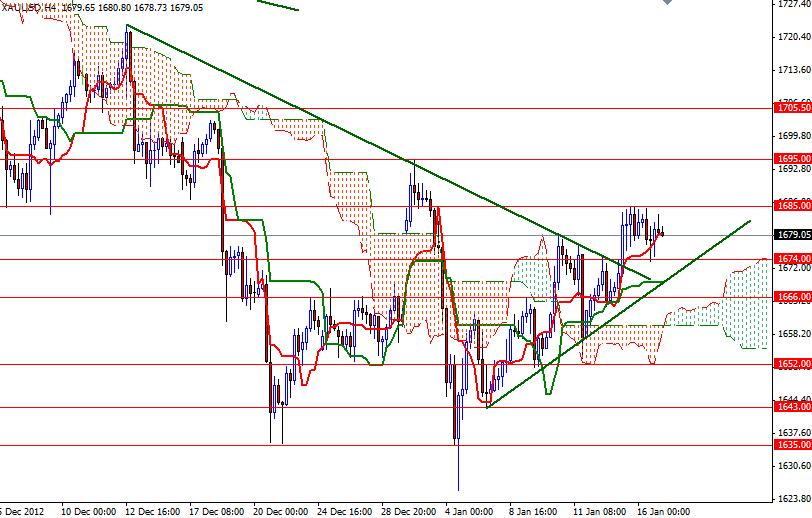

XAU/USD tried to break through the 1685 level but the bulls did not have enough gas, as a result prices pulled back to the 1674 level, which is the Kijun sen line (twenty six-day moving average, green line) on the daily chart, before rebounding back to 1679. In other words, at the end of the day we were back to where we started, indicating the short term bulls and bears are roughly in equal balance at the moment.

From a purely technical standpoint, the pair will remain bullish in the near future as long as it trades above the 1652 level, the bottom of the previous consolidation area. But I have to admit that yesterday's price action was very poor as the bulls failed at the 1685 level several times. With this in mind, it is possible that we will see some consolidation until the pair finds a direction. If the bulls build some steam and shatter the 1685 barrier, we will be heading towards the 1705 level. Of course, the bulls will encounter some resistance at 1695 before that. If prices fall rather than rise, we have a support at 1674 and then 1666 will likely be the next target with 1652 being the next strong support (and a turning point). A close below 1652 would confirm that the bears are firmly in control again. Keep in mind that we have building permits, housing starts, jobless claims and the Philadelphia Fed manufacturing index data out of the U.S. today which could strengthen the greenback.