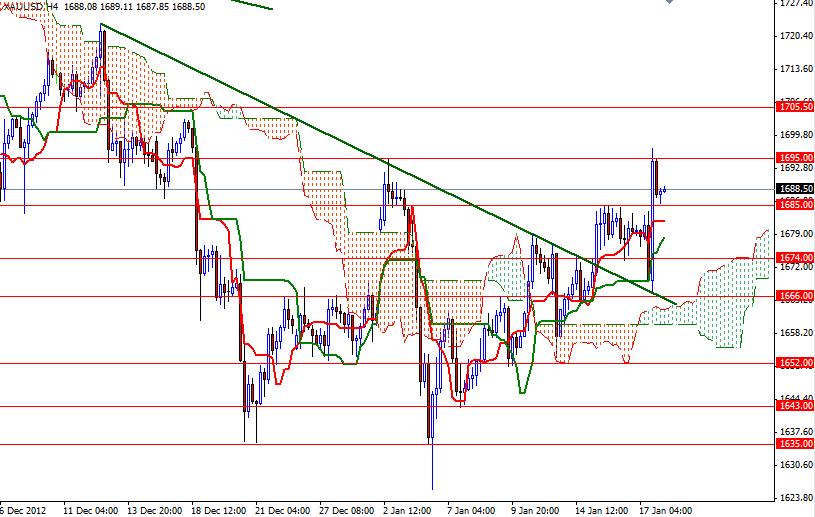

XAU/USD closed higher than opening after a highly volatile session yesterday. Gold prices rose to its highest levels in four weeks against the greenback. The XAU/USD pair initially fell sharply after data from the Labor Department showed that the number of Americans filing applications for jobless benefits decreased by 37K to 335K. In addition, figures from the Census Bureau revealed that housing starts climbed to 954.000 from 850.000. Although the pair traded as low as 1666.60, prices reversed and hit 1697 level after a report showed that manufacturing activity in the Philadelphia region contracted in December. The pattern on the charts suggests that the pair will resume its bullish sentiment as long as we continue to remain above the 1666 level and the Ichimoku cloud (the 4-hour chart).

I am expecting prices to possibly march towards the top of the descending channel at the 1705 level. 1705-1715 zone will be a critical one for this pair as we saw the sellers came in and increased the pressure several times in the past. On the daily time frame, the Tenkan-sen line (nine-period moving average, red line) is approaching the Kijun-sen line (twenty six-day moving average, green line). If prices climb above the Ichimoku cloud (the daily chart), we would also have a bullish Tenkan-sen / Kijun-sen cross.

Until that happens, I will be focusing on 1695, 1705 and 1715 resistance levels. If the bears take over and prices start to drop, support can be found at 1685, 1674 and 1666.