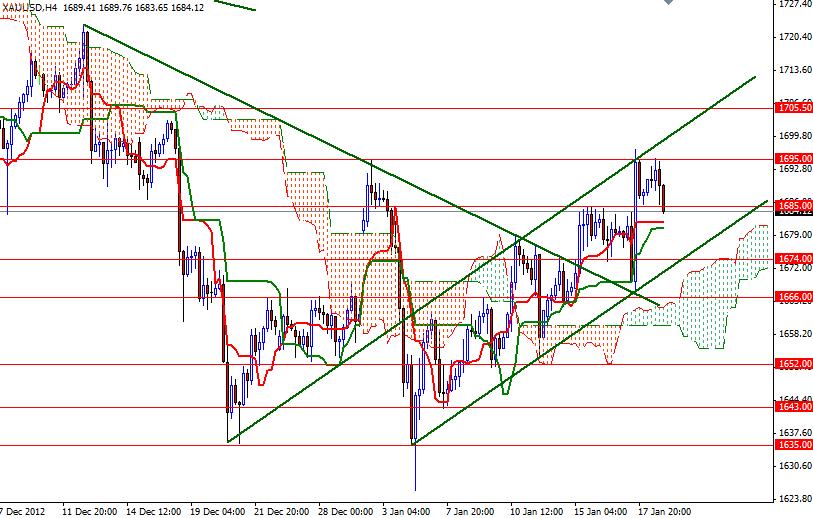

The XAU/USD pair seems to be picking up momentum since the prices bounced off of the 1625.64 level. The pair printed two bullish weekly candles in a row. XAU/USD hit a 4-week high of 1696.99 after better than expected figures from the United States and China eased concerns about the global economic growth. Data Friday from China, the world’s second largest economy, showed that the country's economy grew 7.9% in the fourth quarter of 2012. However, after four bullish sessions, gold prices settled with a loss on the last trading day of the week. The bears managed to drag the pair below the 1685 support level after Republican leaders said they might support a short term debt ceiling extension. From a technical point of view, there are two things to pay attention. First of all, keep in mind that the pair has been following a descending channel since hitting a 13 month high on October 5th at 1795.75 and now we are approaching to the top of the channel where the Ichimoku clouds are located on the daily time frame.

On the other hand, prices are trading above the cloud and supported by a bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross-over (the 4-hour chart). Although the key levels to watch this week will be 1705 and 1666, I will keep an eye on the 4-hour chart as the market has been respecting an ascending channel recently.

If the pair manages to climb and hold above the 1685 level, the bulls will retest 1695 and 1705. A daily close above the 1705 would confirm a bullish extension to 1711.50 and 1717.70. If the pair turns bearish and drops below 1680, support can be found at 1674, 1666 and 1652.