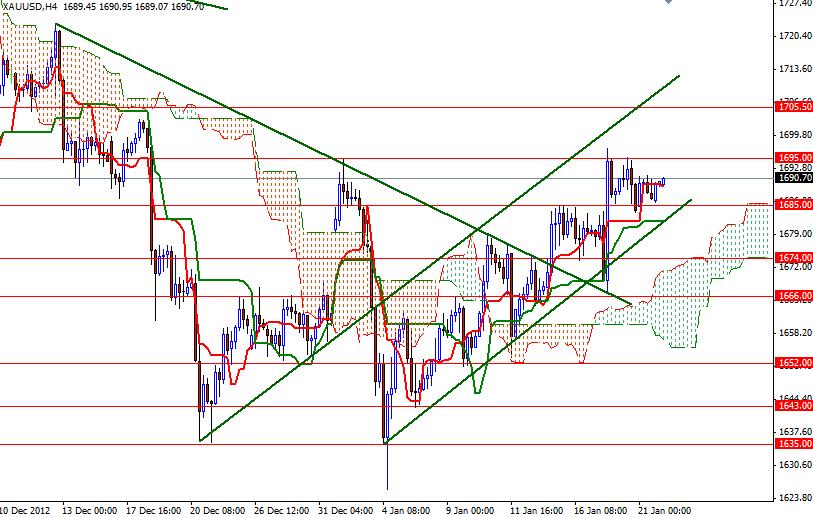

Gold prices ended slightly higher although trading activity was subdued with the financial markets in the United States closed for a public holiday. Today the gold market remains steady during the Asian session as most investors are waiting for the outcome of the Bank of Japan policy meeting. Despite a combination of gold supportive factors such as monetary easing by central banks and low interest rate, large financial institutions continue to cut their forecasts for 2013 and 2014. Meanwhile, investors will be focusing on the health of the global economy and growth. The financial crisis in the eurozone is still the same though the ECB and European leaders have stabilized the situation recently. In the U.S., Republicans in the House of Representatives are planning to win public support by raising the debt ceiling until mid-May. I think today’s main driver will be the price action in the USD/JPY pair. Technically speaking, short term charts are bullish as prices are above the Ichimoku clouds and also the Tenkan-sen line (nine-period moving average, red line) is moving above the Kijun-sen line (twenty six-day moving average, green line). In addition, the XAU/USD pair continues to trade within an ascending trend channel dating back to the January low. I believe today the key to the upside will be the 1695 level. Although there appears to be more strength and volume behind the bulls, the 1705 level is a strong resistance level. I suspect we will encounter some heavy pressure there. I will be keeping an eye on the daily chart, especially on the descending trend line and cloud. If the bulls manage to break above that level, 1711.50 and 1717.70 levels will probably be the next targets.

However, if the bears take over and prices start to fall, expect to see support at 1685, 1674 and 1666.