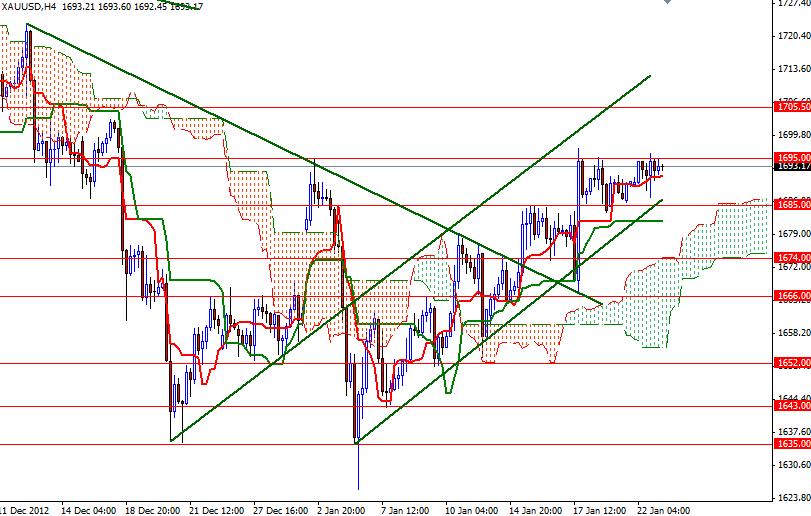

The XAU/USD pair managed to stay above the 1685 level as easing concerns over the global growth continued to attract buyers. Also the recent weakness in the American dollar has been providing support for safe-haven gold. Gold prices climbed from 1625.64 to 1695 in 3 weeks. However, the bulls are struggling to break through the 1695 level for the last four sessions. As a result, the pair has been bouncing between 1685 and 1695 as we lack a strong catalyst to break out either way. Yesterday, a report released by the National Association of Realtors showed sales of existing homes fell 1% in December and figures from the Federal Reserve Bank of Richmond revealed that composite manufacturing index dropped to -12 from 5. Today the market participants will be watching the news from the United States closely. Today the House of Representatives will vote on suspending the debt ceiling by extending the federal government's borrowing capacity until May 19th. In the meantime, the key levels to watch will be the boundaries of the recent consolidation (1685 and 1695). If the bulls push the pair above the 1695 level, I believe they will gain enough traction to visit the 1705 level where the daily Ichimoku clouds and a descending trend line converge.

Beyond 1705, there will be more resistance at 1711.50 and 1717.70. A daily close above the clouds (and the descending trend line) could trigger a new wave towards the 1735 level. However, if the bears successfully defend the 1695 and prices reverse, support can be found at 1685, 1674 and 1666. A break below 1666 would increase the downward pressure and open the doors to 1635, at least.