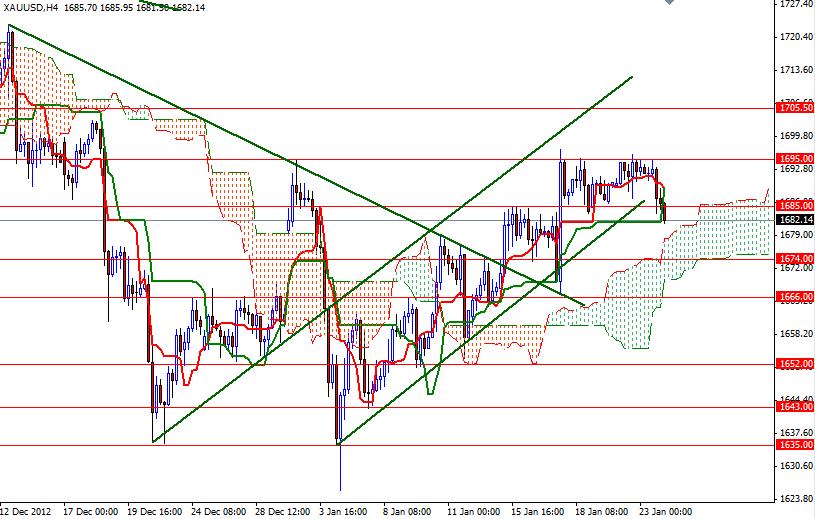

We tried to climb above the upper band of the 1685-1695 zone and didn't have enough gas. The XAU/USD pair closed lower than opening after lawmakers in the U.S. House of Representatives approved a suspension of the debt ceiling until May 19th. The House passed its plan with 285-144 vote. It seems that the debt ceiling will be out of the headlines for some time and the gold market's attention will turn to economic data releases. U.S. data released this week were not as strong as hoped but were respectable. Meanwhile the Federal Reserve's easing is going to continue as the central bank is still looking for a sustained improvement in the employment numbers and it will take some more months to see that. Although we still have a bullish picture on the 4-hour chart, gold prices continue to remain below the Ichimoku cloud and inside a descending channel on the daily time frame.

I believe the XAU/USD pair will be heading back to the bottom of this channel unless we see a strong close above the 1705 resistance. With so much strong resistance above, it will take some work for the bulls to break through. But if they do, their next targets will be 1711.50 and 1717.70. In order to confirm a bearish continuation, I will be looking for a break below the 1666 level, a strong support and also the Kijun-sen line (twenty six-day moving average, green line) on the daily chart.

If this floor is breached, we will probably see prices fall to 1652 or 1635 next. In the meantime, this pair is likely to continue its consolidation in the 1695-1674 zone.