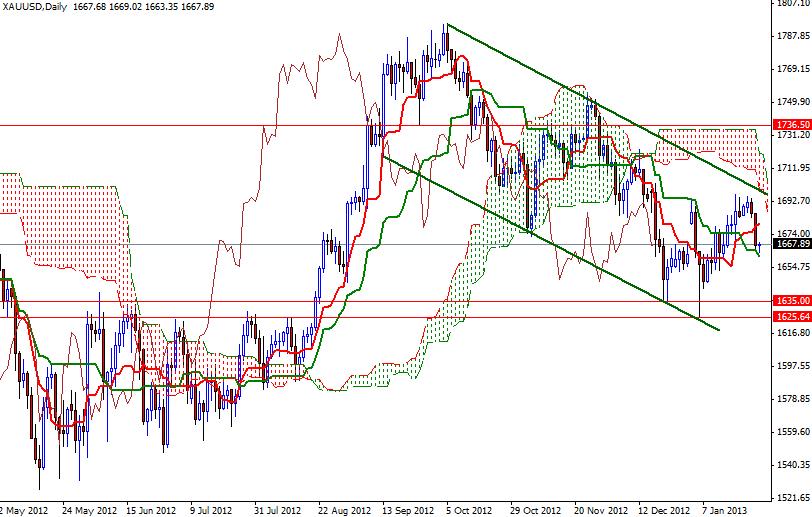

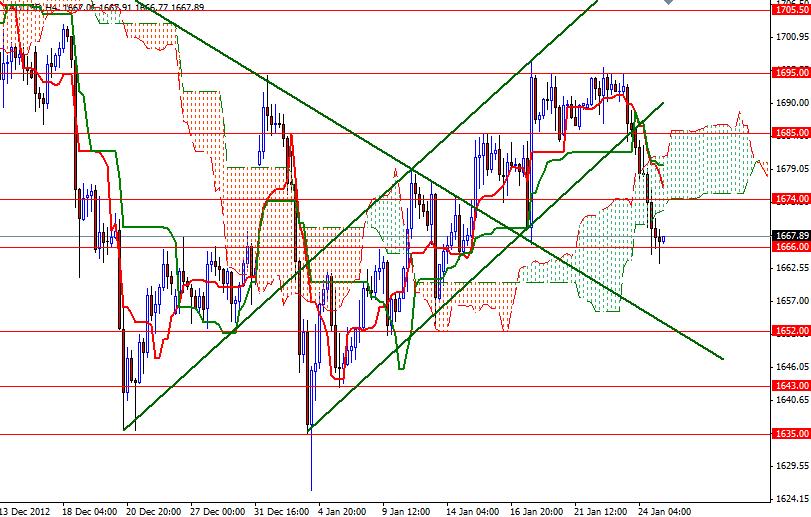

Gold prices dropped after data released yesterday provided further evidence that the U.S. economy is continuing to heal. Investors’ confidence in gold has been diminishing since the U.S. House of Representatives passed a bill to extend the debt ceiling limit until May 19th. Data released by the U.S. Labor Department showed that the number of first-time applicants for jobless benefits decreased 5K to 330K. Also Markit's Flash Manufacturing purchasing managers’ index was above the expectations. Honestly, yesterday’s price action is not surprising at all, especially considering the fact that the bulls encountered strong resistance at the 1695 level. As I mentioned in the previous analysis, I believe that the XAU/USD will remain bearish unless the bulls somehow manage to pull prices above the 1705 level. The descending channel which the pair has been running in since October will be our guide. We are hovering just above a critical support level of 1666 at the moment and I think we will see some bounce before heading lower. While the XAU/USD pair is back below the Ichimoku cloud, the Kijun-sen line (twenty six-day moving average, green line) on the daily chart is at 1661.34.

Therefore, 1666-1661 zone will be the key level for the bears before challenging 1652. Below that, expect to see more support at 1635 and 1625. To the upside, resistance will be found at 1674, 1685 and 1695.