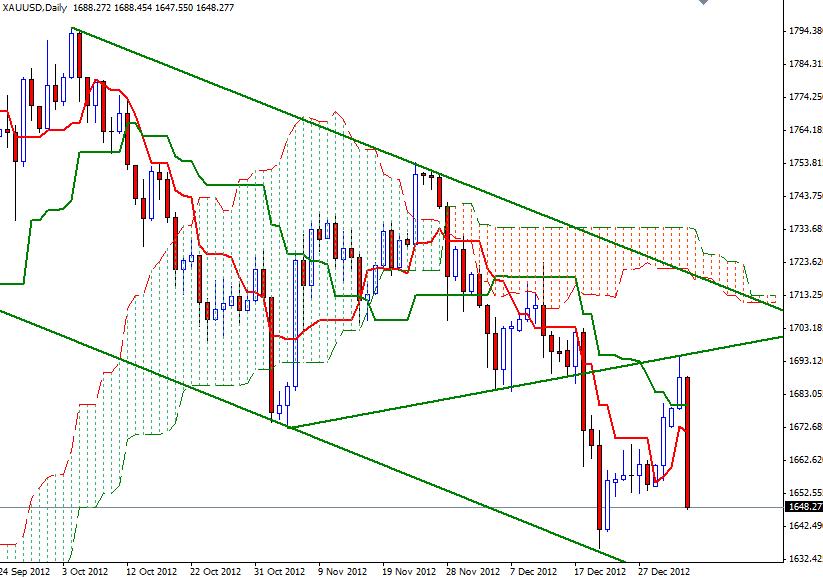

XAU/USD fell sharply after the bears increased selling pressure and pulled the pair below the 1684 support level. We see that the relief rally is running out of gas as the markets turned their attention to the economic data releases again. On Wednesday, U.S. President Barack Obama signed the legislation which extends tax cuts for the middle class. Yesterday the American dollar strengthened across the board after the minutes from the Federal Open Market Committee's December policy meeting surprised market participants and ADP Private jobs report beat expectation. According to the records, “a few members expressed the view that ongoing asset purchases would likely be warranted until about the end of 2013, while a few others emphasized the need for considerable policy accommodation but did not state a specific time frame or total for purchases. Several others thought that it would probably be appropriate to slow or to stop purchases well before the end of 2013”. The pattern on the daily chart suggests that there is more volume and strength behind the bears at the moment and the pair is likely headed for the first critical support level at 1642.75.

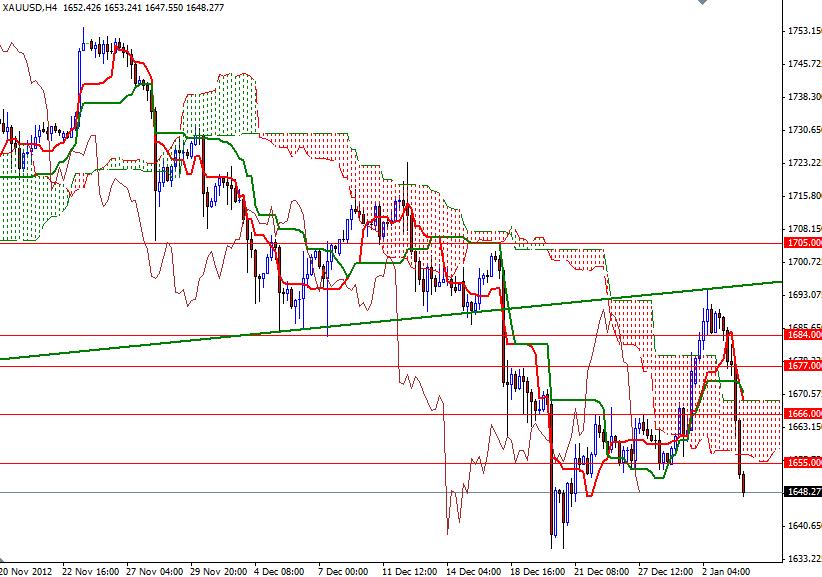

On the 4-hour time frame, the Tenkan-sen line (nine-period moving average, red line) crossed below the Kijun-sen line (twenty six-day moving average, green line). In addition prices dropped below the Ichimoku cloud, indicating that the bears are in control. I think the pair will find some support around the 1642.75 level and test 1655 resistance before going deeper, so today the key levels to watch will be 1655 and 1642. If the bulls gain some strength and push the pair above the 1655 level, we may revisit the 1666/1669 zone. A close above this zone could shift things to the bulls. However, if the bears manage to defend the 1655 level and pull prices below 1642, look for 1635, 1628 and 1624.