Although XAU/USD fell for the week, Friday’s price action was really interesting. The XAU/USD pair broke below the 1655 support and (almost) touched the bottom of the descending channel (1625) and climbed back above the 1655 level, printing a hammer on the daily chart. XAU/USD gained sharply after the Labor Department said non-farm payrolls grew by 155000 jobs last month and the unemployment rate increased to 7.8% from 7.7%. The figures dented speculations that an end to excessive Fed policy ease was imminent. Even if the data released on Friday provided further evidence that the U.S. economy is continuing to heal, we are still far from the Fed’s target for a sustained monthly increase in jobs of 200K/month. Short time frame charts turned bullish but prices remain in the Ichimoku cloud on the weekly time frame.

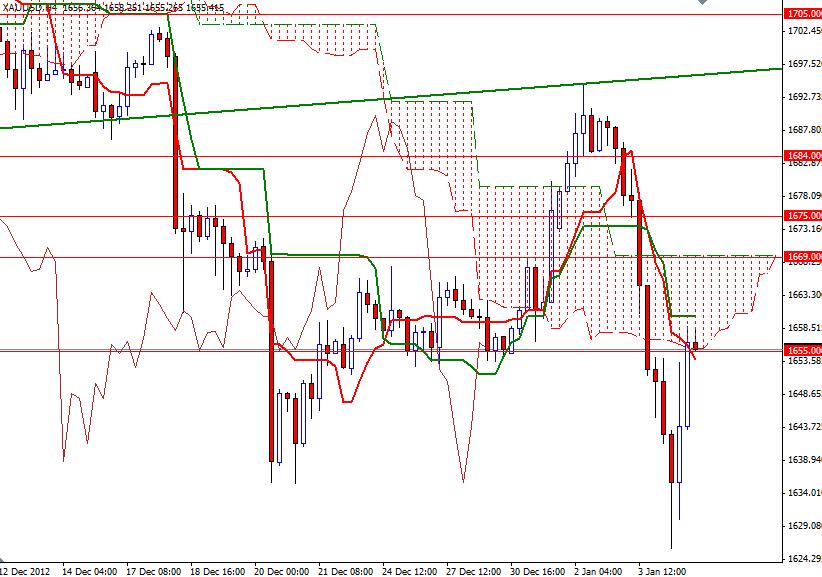

We have a similar situation on the 4-hour chart. From a technical point of view, in the short term, I think the XAU/USD pair will consolidate between 1652 and 1699 levels. If the Tenkan-sen line (nine-period moving average, red line) crosses above the Kijun-sen line (twenty six-day moving average, green line) and prices break above the Ichimoku cloud (4-hour time frame), that would be a strong bullish signal. If that is the case, I will be looking for 1675, 1684 and 1695. The key support to watch will be the 1648 level. If the bears take over and drag the pair below this level, expect to see more support at 1643, 1635 and 1628.