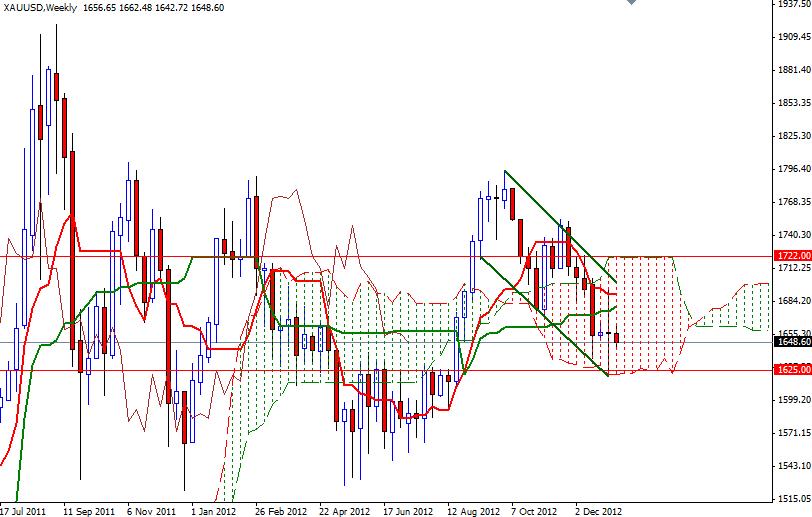

XAU/USD closed lower than opening yesterday as the initial rally faded after the bears run out of steam at the 1660 resistance, which is the Kijun-sen line (twenty six-day moving average, green line) on the 4-hour chart. The fiscal cliff is out of the headlines for the moment but the Fed minutes released on Thursday continue to play a crucial role on investors’ sentiment. Although recent reports shows the central banks around the world continue to purchase gold as a way of strengthening and diversifying their assets, how the Federal Reserve plays its cards will have a strong impact in the gold market. Quantative easing is considered as a positive element for gold because it encourages market players to buy the shiny metal to hedge against the declining value of the greenback. In the meantime, the market participants will be focusing on the ECB policy meeting and economic data out of China. The pattern on the weekly chart suggests the XAU/USD pair will continue to be choppy and range bound for some more weeks while the daily and 4-hour charts remain bearish.

Prices are below the Ichimoku clouds on both the daily and 4-hour chart. In addition, we have bearish Tenkan-sen (nine-period moving average, red line) Kijun-sen line (twenty six-day moving average, green line) crosses. Today the key levels to watch will be 1653 and 1643. If the XAU/USD pair pulls itself out of the bears grip and manages to hold above 1653, we will probably visit 1660 and 1666 levels again. The real challenge will be waiting the bulls at 1677 and 1685. If the downward pressure continues and the 1643 level gives way, look for 1635, 1628 and 1625.