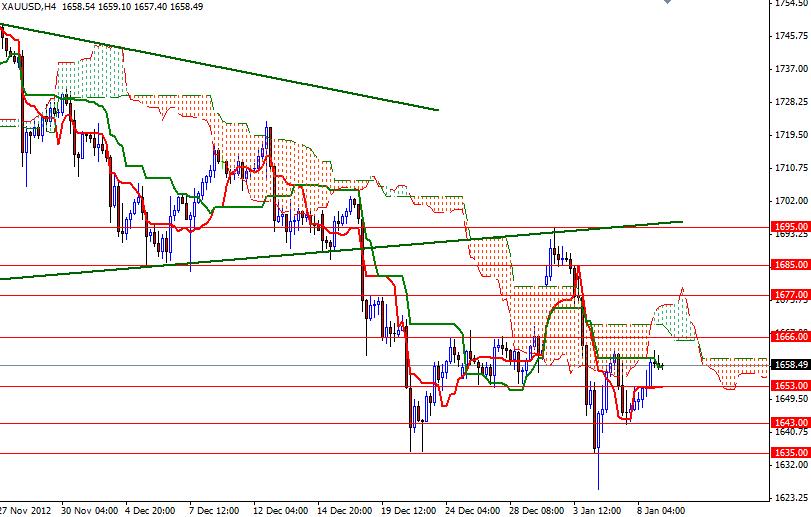

XAU/USD (or gold vs. the greenback) has been basically bearish since October 2012 when it 1795.75. Last week the pair touched 1625.64, the bottom of the descending channel that we have been following since October 5. The bearish action on the XAU/USD may be coming to an end. Yesterday the pair bounced off of the 1643 support level and closed above the 1653 resistance. 30M and 1H charts are pointing higher prices as we have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen line (twenty six-day moving average, green line) crosses and prices are above the Ichimoku clouds. This could just be a temporary retracement. It is hard to tell this point time, but 1643 appears to be supportive and because of this I think that consolidation is probably the way forward in the short-term. Today the key levels to watch will be 1666 and 1653. If 1653 holds, I will look for prices to retest 1666. If the bulls manage to break through, then 1677 and 1685 levels will be the next targets. However, if the bulls increase the selling pressure and prices start to fall, I expect to see support at 1653. If this level is breached, we may go back to the 1643 level. A break below 1643 would indicate that the bears are firmly in control and our next stop is the 1635 level.

Gold Price Analysis - Jan. 9, 2013

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo. - Labels

- Gold