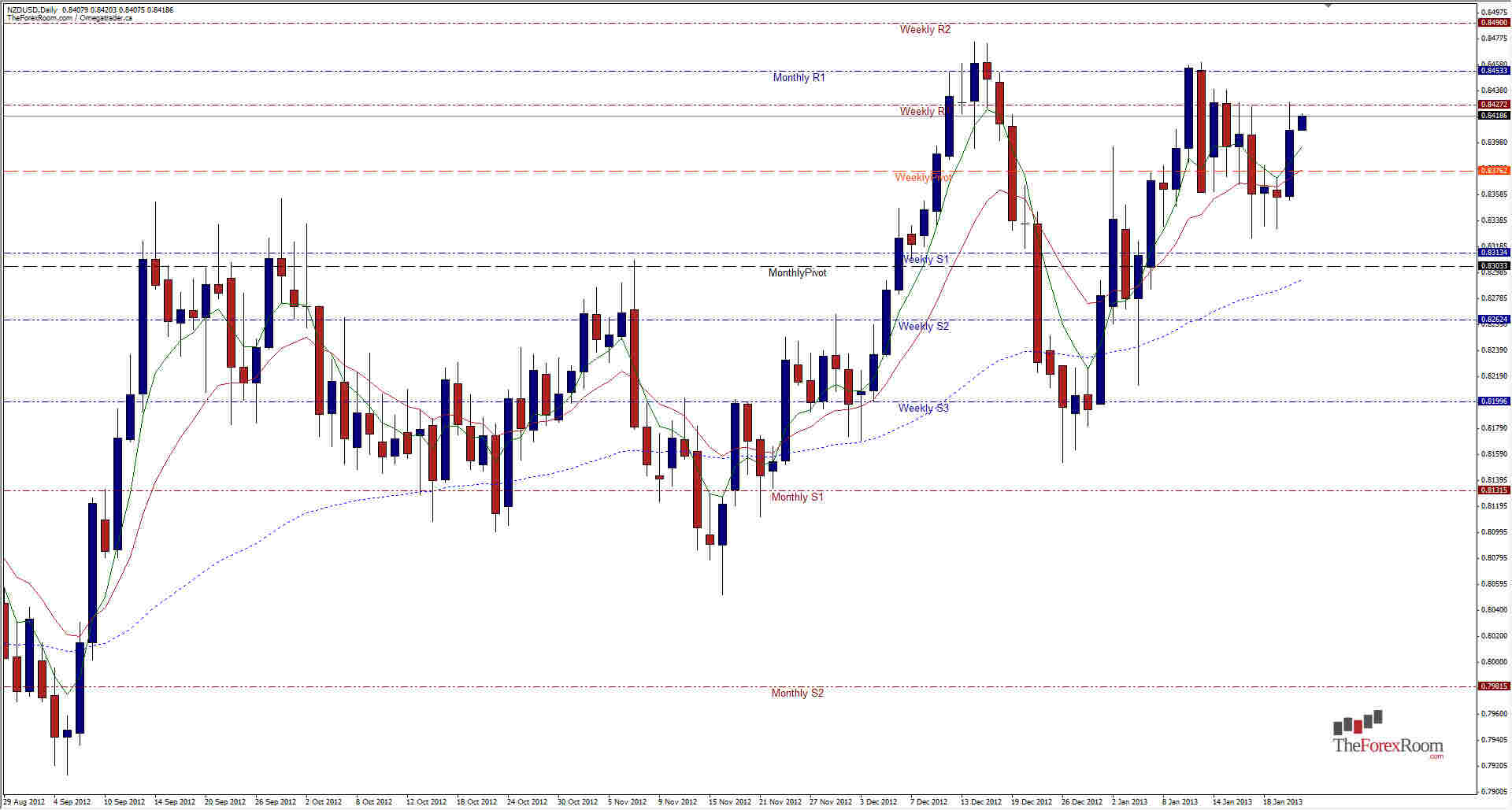

The NZD/USD aka Kiwi climbed over 70 pips from open yesterday after the BOJ doubled its inflation target to 2 percent and adopted an open-ended commitment to buy assets starting 2014. The pair seems to be solidly planted in an uptrend that could see it heading towards prices not seen in a year and a half if the current trend continues. December high's will be the first hurdle to overcome at 0.8475 backed up by the Weekly R2 at 0.8490. Between the current price of 0.8416 we also have the Weekly R1 at .0.8427 and Monthly R1 at 0.8453, so as you can see the Bulls have plenty to work through. Above 0.8490 however, there is basically a technical vacuum up to the 2011 highs of 0.8842 with resistance offered at 0.8540 and 0.8625. Should the pair fail to break the 0.8450 level we will most likely fall back towards January lows at 0.8215 with support impeding the bears at 0.8315 and the Monthly Pivot at 0.8300 before the 62 Moving Average comes into play at 0.8290. Further support is offered at the Weekly S2 of 0.8264. Also of note is that the pair is setting up to 'fade the tail' of last months Bearish Pin Bar on the monthly chart. The top of the tail sits at 0.8475.

Kiwi Climbs After BOJ- Jan. 23, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- NZD/USD