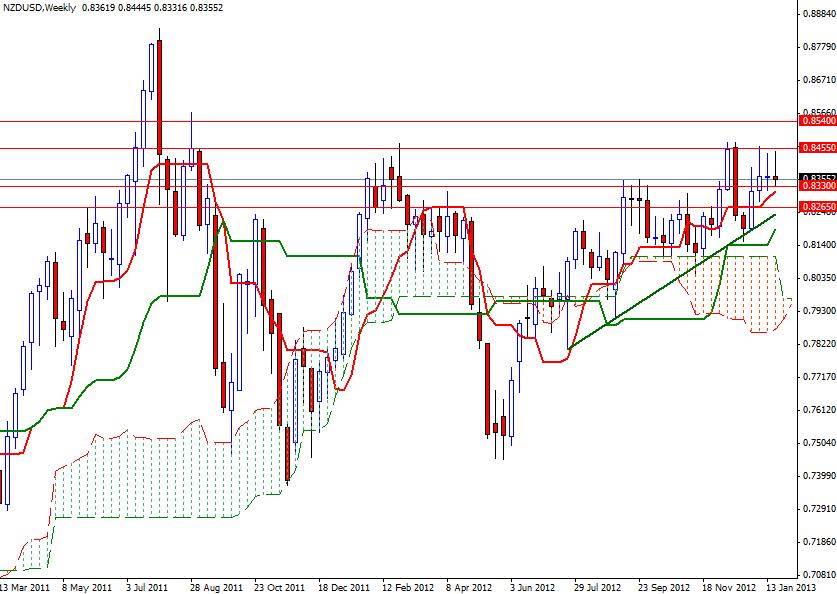

The NZD/USD has been range bound for almost three weeks as the pair is trapped between 0.8455 and 0.8330. As a result of better-than-expected data from China and Australia, the New Zealand dollar continues to show resilience against the greenback. However, the bullish pressure seems to be diminishing each time we get close to the 0.8440/55 area. Finally the U.S. debt ceiling issue is out of the headlines for the moment and improving economic data from the United States is giving the bears more strength to fight. On the daily time frame, the pair is above the Ichimoku cloud and we have a bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen cross.

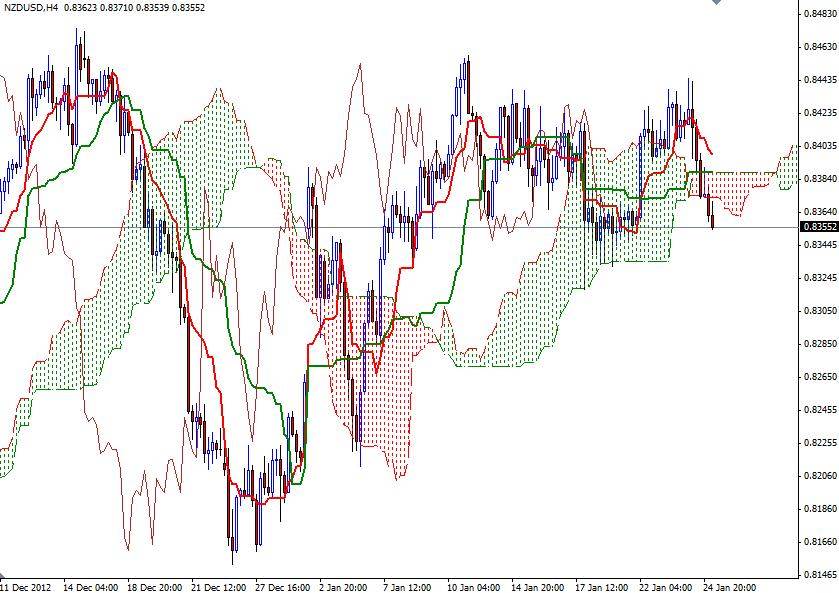

But the 4-hour chart is giving a warning signal. Prices dropped below the cloud and if the pair fails to get back above the 0.8400 level, we will have a bearish setup (for the first time since December 21st). This situation makes the 0.8330 support level more important. If the 0.8330 floor is breached, I expect to see prices falling towards the 0.8265 zone.

A close below the 0.8265 support level would confirm that the bears are firmly in control. However, if the bulls successfully defend the previously mentioned support level and build some steam, look for 0.8390, 0.8420 and 0.8455. A daily close above the 0.8540 will probably increase speculative buying pressure and the next target will be 0.8540.