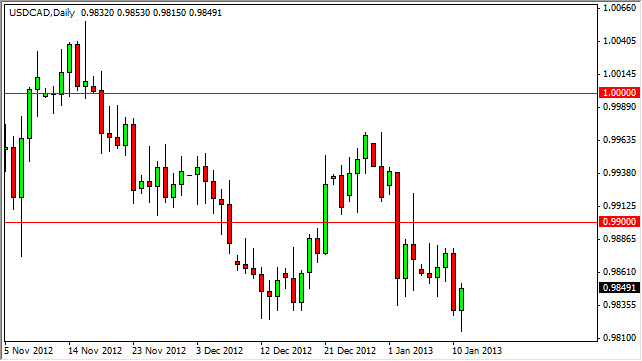

The USD/CAD pair fell during the Friday session as we broke below the recent lows in order to make a serious attempt at the 0.98 handle. However, by the end of the day we get a significant enough bounce order to form a hammer. This hammer is of the prettiest looking thing, but it does suggest to me that we are not quite ready to break down at this point. It should also be noted that the oil markets produce very similar, albeit inverse, moves.

With this being said, I'm still bearish of this pair but I think that we need to consolidate further. This really isn't that surprising, as the USD/CAD pair tends to do so over long periods of time. However, once we managed to break down below the 0.98 handle on a daily close, this should be a fairly explosive move to the downside. In fact, I think we will see 0.95 much quicker than many of you expect.

Watch the oil markets

Unfortunately, the Brent market looks absolutely horrible for the short-term. The $113.00 level seems to be a bit of a brick wall, and price simply cannot get through there to become a much more bullish market. The Canadian dollar tends to follow oil in general, and as a result it will more than likely need that move in order to push demand for the Loonie.

The Light Sweet Crude market looks very similar, although not quite as bearish. The $95.00 level seems to be very resistant, and will take a significant amount of pressure to break through. However, if we do it should be noted that the Canadian send a lot of this stuff south of the border and into the United States. This of course has a massive effect on monetary flow and increases money flowing out of the United States and into Canada which naturally will make this pair fall. Also, it should be noted that a move above the $95.00 level has almost no resistance until we hit $100.00 in that market. That means that the move in this market below the 0.98 handle could be rather swift. As for buying, not only is it against the overall trend, but I see the 0.99 handle as far too resistive at this moment.