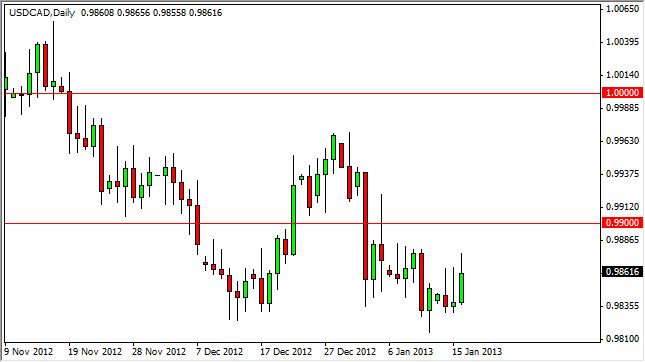

The USD/CAD pair rallied during the session on Wednesday again, and unlike Monday and Tuesday managed to keep at least some of the gains. However, I still see quite a bit of resistance above at the 0.99 handle, and possibly even lower. With that being said, I fully expect to see this pair continued to consolidate sideways as a typically does for great periods of time.

One of the biggest influences in this pair of course is the oil market. Currently, most oil markets look like they're trying to break down, and as a result we could eventually see the catalyst to move lower in this pair. I see the 0.98 handle as being extremely important for the sellers, and if they can capture that with a move to the downside they should open the door way to the 0.95 level.

Divergence in the oil markets

Having said that, the Wednesday session did see a lower Brent market, while the light sweet crude contract showed serious support. Because of this, it appears that perhaps the spread between the two contracts are going to narrow. If that's the case, it's hard to tell what effect it would have on the Canadian dollar, but in my experience the light sweet crude market is the one you should be watching more than anything else.

Looking at the charts on this pair though, I can definitely make a case for a bounce back to the 0.9950 level in the short-term. That would almost undoubtedly coincide with lower oil prices as well. Of course, these markets can move independently but they typically don't.

The biggest problem with trading this currency pair is that both of these economies are so intertwined. It is because of this that this pair can shop sideways for quite some time. After all, the Canadian send so many exports south that anything that happens in the United States certainly has and the fact on how much the Canadians export. Because of this, the United States can only get so bad before it starts to affect Canada as well. Having said that, it does appear that the United States is starting to strengthen economically, and if that's going to be the case then the oil exports coming from Canada should continue to strengthen over time therefore creating demand for the Canadian dollar.