The USD/CAD pair initially rose during the session on Monday as traders begin to worry about the fiscal talks going on in Washington DC. However, as the day wore on there came more and more signs of positive U.S. Congress dealing with the fiscal talks that have driven the headlines over the last couple of weeks.

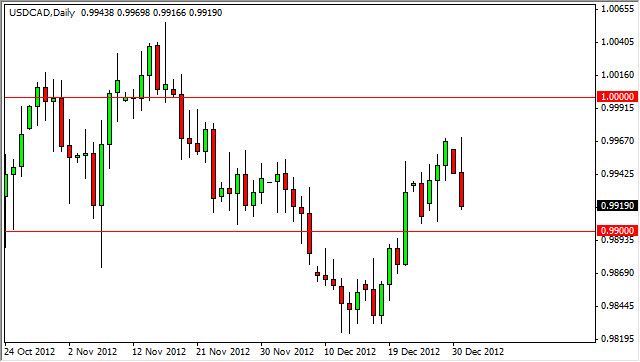

However, the 0.99 handle still has held as support, and as such one can only assume that the support is still in play. Quite frankly, and be difficult to know what the markets would do under normal conditions because the volume was very thin and most Forex brokers closed early. Because of this, we did get a true read on the market reaction and we probably won't until the end of the Wednesday session at the very earliest.

Looking this chart, it's easy to think that the downtrend would be the clearest trade. This is true in general, but 0.99 handle does look to be somewhat supportive, and that would have to be overcome on a daily close in order to be comfortable selling. Of course you have the overall trend working in your favor, so that doesn't hurt either.

Much to do about nothing?

A lot of the gains that we saw on the stock markets late during the Monday session or based upon the idea that Congress has come together with some type of solution. The reality is that a lot of what the Congress managed to get done will be less than stellar, and as a result we still have a fairly high chance of seeing a "risk off" move once everybody gets a chance to read whatever they come up with. After all, nothing has been signed yet and it appears that the President had a news conference during the Monday session simply to aggravate House Republicans. Certainly, this will do nothing to move the ball forward.

Going forward, we have the debt limit argument to look forward to as well. Because of this, I suspect that this pair will continue sideways and erratic for the foreseeable future. Nonetheless, if we see a daily close below 0.99, we would have to consider it a decent sell signal. As for buying, I need to see this market clear the 1.0050 level to be convinced that a lot of the noise above has been cleared out.