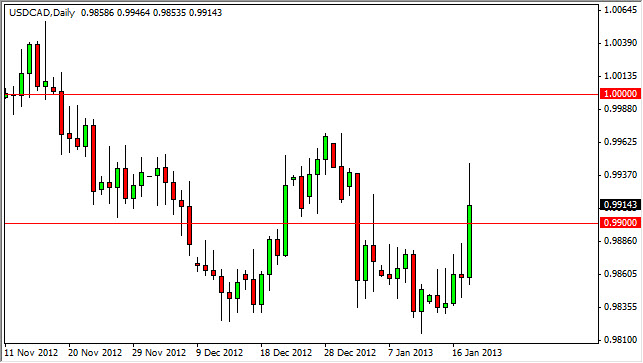

The USD/CAD pair shot straight through the roof on Friday, managing to leapfrog the 0.99 handle for the first time in two weeks. Although this is a relatively bullish sign, the biggest problem I have with this move is the fact that we are in such a strong downtrend, and the fact that we gave back quite a bit of the gains towards the end of the day.

The biggest problem I have with the giveback isn't the size of it, the fact that it was on Friday, and traders were not willing to hold onto the Canadian dollar over the weekend. Then to me just shows that a lot of week hands being played right now, and they typically are the first to bail out of a trade. Because of this, I think that we will eventually go lower and am very comfortable shorting this pair right now.

Consolidation

This pair has been consolidation for a couple of months now, and I think we simply are still doing the same thing. Because of this, I see a lot more downside in this pair than off. I also believe that the parity level is going to be far too strong for the pair to breakout of right now barring some type of economic shock. Oil is breaking ounce at the same time, so this generally favors the Canadian dollar anyway. Because of this I believe that we have and inefficiency in this marketplace is now, and we will see selling almost right away.

With all things being equal, I prefer to hold the Canadian dollar in general as the overall downtrend has been so strong. I believe that the 0.98 handle is still the real target and if we can get below that we could really start to see some fireworks as is pair falls apart. Below there, I think it's a pretty easy trip down to 0.95, and probably quite a bit lower. With this being said, I firmly believe that selling at this point is relatively safe, although you would have to give a little bit wider than usual stop loss if you want to cover the parity resistance area.