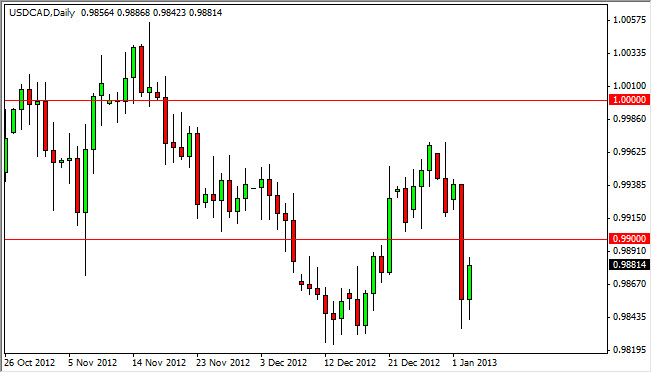

The USD/CAD pair initially fell during the session on Thursday, but bounced slightly off of the 0.98 region in order to form a somewhat hammer like looking candle. While I don't see this is a hammer per se, I do see the fact that this is a market that is trying to bounce around between the 0.98 and 0.9950 handles. This market looks like it's trying to stay within consolidation, and I believe this makes sense as we head towards the debt ceiling talks in Washington DC. Yes, I did see debt ceiling talks, and yes, it is just as bad if not worse than the so-called "fiscal cliff" talks that we just got through.

Because of this, this pair will continue to be very choppy going forward. However, I think if we managed to break down below the 0.98 handle we would have a significant sell signal that could last for several handles. This would more than likely coincide with a strong jobs number today, and it is the easiest route for price to follow at the moment.

Nonfarm payroll

The USD/CAD pair is probably the most sensitive currency pair to the nonfarm payroll numbers. While most people focus on the Euro or the Yen, this pair typically moves the most during this first Friday of the month. Because of this, it is one that I always watch, and I think that if we get anything closely resembling a bullish jobs number we should see a significant move.

I know it sounds a bit counterintuitive, but the Canadian dollar gains as the US economy does. This is because Canada sends so many of its exports to the United States; they need to help the customer in order to function correctly. If we are starting to see the end of the malaise that has been going on in United States, Canada will do quite well. With this being said pay attention to the oil markets as well and if they can break above the $94 level and the light sweet crude market, his pair will almost undoubtedly break below the 0.98 handle.