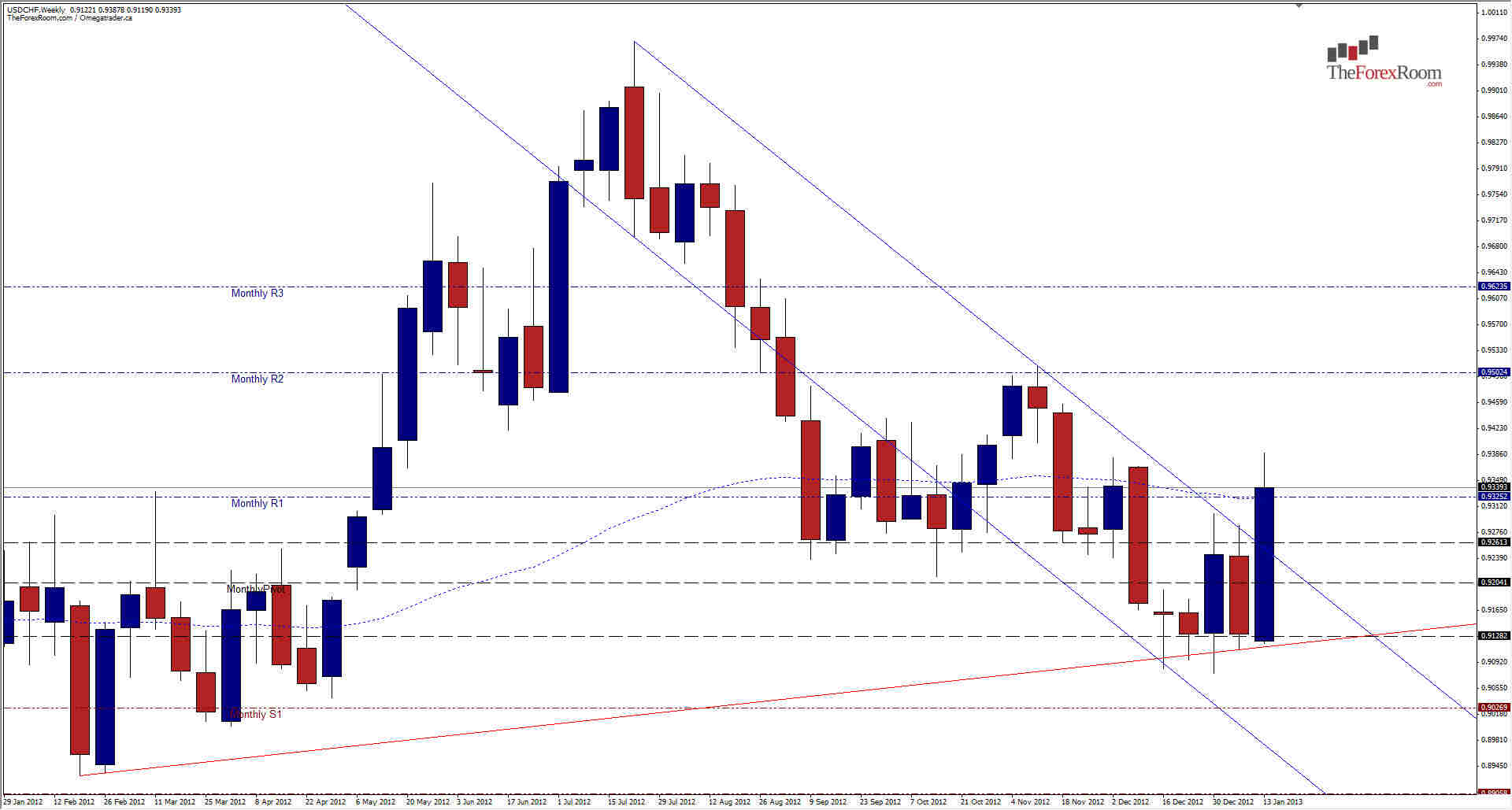

The Swissy (USD/CHF) printed a Weekly Engulfing candle last week off of the support level at 0.9100 that has halted it's decent for the past 5 weeks in a row. The pair closed out the week at 0.9388 after opening at 0.9119 and has closed above both the Monthly R1 and the 62 Moving Average. Such a strong candle closing outside of the descending channel suggests that prices will be aiming for new heights in the days ahead, most likely the Monthly R2 at 0.9500 to begin with. A pull back to around 0.9260 (38.2 FIBO) would not be a big surprise first however, or even the Weekly R1 at 0.9242 (50% FIBO). The pair will face heavy resistance at 0.9420 on the way up, and above 0.9500 will face resistance again from the January 2012 high of 0.9595 before opening up a technical vacuum up to around the 0.9840 area. Should things reverse, and get below 0.9240, the key remains the 0.9100 area. Any close below 0.9100 on a daily or weekly basis could signal a much deeper drop, possibly to February 2012's lows of 0.8930, or even the all time low at 0.7081 in the long run. For now, things are looking Bullish, but as the EURO remains strong will we see a full disconnect between the pairs and watch both climb? Or is the weakness of the Swissy the precursor to the fall of the EURO? Time will tell, but for now I will look to buying opportunities in the USD/CHF.

USD/CHF Looks Towards .09500

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.