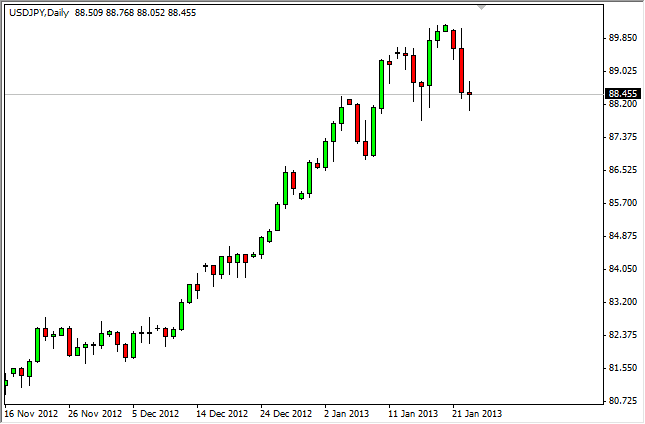

The USD/JPY pair fell during most of the session on Wednesday, as the Yen continued to gain overall. However, by the end of the session we bounced enough to form a hammer like candle. This candle will have been the second one in the course of two weeks at the same place. Because of this, it looks to me that the 88.50 level is going to try and offer a bit of support.

Looking at this chart, I can also see the potential for the 86.50 level to offer support as well, and as a result I am in a "buy only" type of bias. Certainly, the Bank of Japan will continue to work against the value of the Yen, and as a result the pair should continue to go higher over the long run. However, we have had a significant move recently and it would not surprise me to see a major pullback at this point.

84

I can see the possibility of a move all the way back to 84. I don't necessarily expected, but the 84 handle is the "floor" of this market as far as I can tell. If we managed get below that area, then certainly the momentum by the buyers will have failed. If that's the case, then obviously the pair would continue to go down but would eventually attract the attention of the Bank of Japan, which is quite well known for its interventions.

I do believe that this pair goes higher and eventually breaks above the 90 handle. The 90 handle will be a significant amount of resistance though, and as such we may simply be trying to wind up for that move. This would make sense as the consolidation should have buyers interested in the market. Having said that, there are a lot of people who have simply missed this move higher, and are going to be a bit put off by buying this market up here. Getting a nice pullback would of course alleviate that problem though. The question now is whether or not we have dropped far enough to attract those people into the marketplace. It's only a matter of time, and as such I simply wait for my opportunity to start buying this pair yet again.