The USD/JPY pair has been on an absolute tear lately as the Bank of Japan has recently announced that they were going to go out of their way to devalue the Yen. The skyrocketing value of the Japanese currency has been killing the export economy for this country, and as a result drastic actions will have to be taken.

Because of this, the newly elected government in Japan has put pressure on the Bank of Japan to essentially print unlimited Yen in order to fight deflation. You have to keep in mind that this country has seen deflation for 20 years now, and as a result this is a tall order. But by taking drastic measures, the government believes it can reach its 2% inflation mandate.

It really doesn't matter whether or not they can, it's the fact that they are willing to blow up their own currency that has traders concerned about owning it. On the other hand, you have the United States that to be doing a bit better and as a result this pair has been rising in value.

90 handle

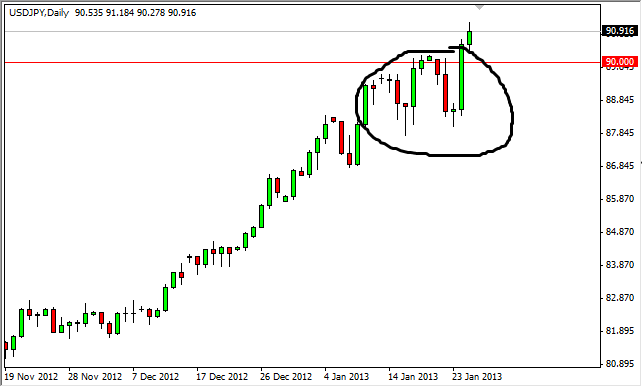

The 90 handle was a very important resistance point in my opinion. Now that we have broken above it, I believe there should be a ton of support just below it. If you look at the price action just below the 90 level, you can see that a lot of back-and-forth action was going on for a couple of weeks. This should do know quite a bit of "noise" underneath, and provide support going forward.

Look at the longer-term charts I believe that we could see this pair rise to the 95 level. In fact, I believe it goes much higher than that over the long-term, but I think that 95 will be the next target. Because of this, I believe that buying on the pullbacks will be the way to go forward. It should be noted that this Friday has the Americans releasing their Non-Farm Payroll numbers, and that market can cause havoc with his pair at times. However, if the number is fairly poor and we get a knee-jerk reaction to the downside, I could provide a buying opportunity as this pair is running on different fundamentals than the employment situation for the moment.