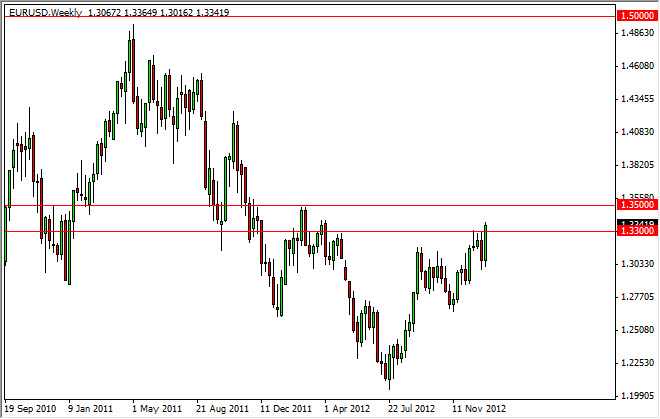

EUR/USD

The EUR/USD had a lot of fireworks during the week as we saw the pair smash through the 1.33 level like it wasn’t even there. The area between 1.3150 and 1.33 should have been very resistive, but proved not to be in the end. A few choice words out of Mario Draghi’s mouth and everyone runs for the hills and covers their shorts in this pair. It now appears that we are heading towards 1.35, and if we can get through there – much, much higher as an inverse head and shoulders will have been triggered at that point. This pair could be starting a new trend higher again.

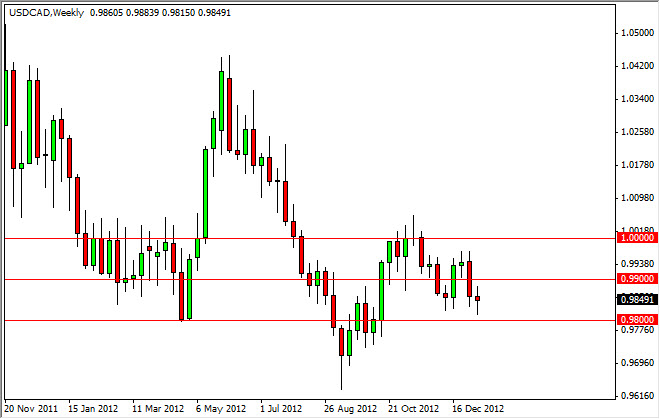

USD/CAD

The USD/CAD pair continues to be dead money from the longer-term perspective. However, this consolidation area between 0.98 and parity will eventually have to give way, and when it does we should see a rapid move if history is any indicator. The most likely scenario is that we break down below the 0.98 level, and when we do – we should see continued weakness in this pair. However, a break above the 1.0050 level would have this pair in full rally mode. Until one of those moves happens – this pair is stuck in a rut.

AUD/USD

The AUD/USD pair attempted to breakout at the 1.06 handle over the week, but failed. To be honest, I am surprised we haven’t yet – especially with better than anticipated Chinese economic numbers coming out lately. However, we haven’t broken out and in fact pulled back enough on Friday to form a shooting star. That being said, I am not expecting a meltdown, just a simple pullback at this point in time. The 1.04 level would be a great place to buy supportive action if we get that low. Obviously, a break over the 1.06 level would be massively bullish.

EUR/AUD

The EUR/AUD pair isn’t one that normally appears in this article. However, I see a nice downtrend line that is about to get broken. Also, it would imply Euro strength – something we are seeing everywhere, and this is the easiest thesis to work with. Looking at this chart, you could even make a small case for an inverted head and shoulders with the trend line being the “neckline.” If that’s the case, this pair will climb for the foreseeable future.