EUR/USD

The EUR/USD pair has continued to grind higher and higher, and now we find ourselves at an important crossroads. After all, as you can see on the weekly chart, the 1.35 level is an important one historically. Also, it should be noted that the inverted head and shoulders drawn on this chart has its neckline broken at that point, and this would signal extremely bullish momentum.

The “height” of the head and shoulders is 1500 pips, or 15 handles. By adding the 1500 pips to the breakout point at 1.35, you get a target of 1.50 for the move. This seems like a lot, but in reality, you can make a case for this pair simply going back to the top of the 1.20 – 1.50 longer-term consolidation range. I think this pair is going to do this, and on a daily close above 1.50; I am going to buy this pair, and forget about the trade for a year or two.

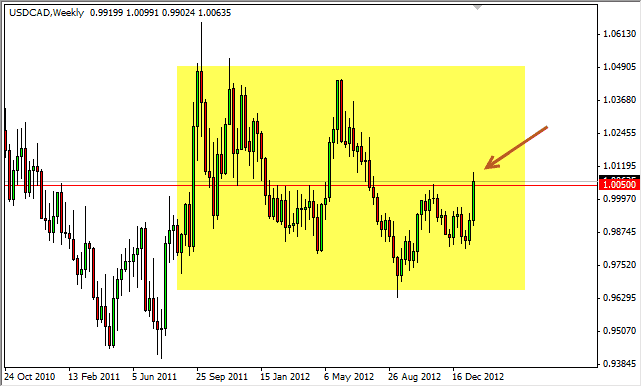

USD/CAD

The USD/CAD pair had been bearish for some time. However, this past week the Bank of Canada suggested that the timetable for an interest rate hike was farther out than expected previously, and this of course sent the CAD lower in value. The oil markets are also rising in value at the same time, which is very odd indeed.

The break of the 1.0050 level is important, and I think this pair could continue higher. However, I wouldn’t feel comfortable going long until we broke over the top of the range for last week. This is essentially the 1.01 level, and this could clear the way for a move back to the 1.04 handle. If we close back under the 1.0050 level, we could drift back down. This wouldn’t be the first time we have had a false breakout to the upside after all.

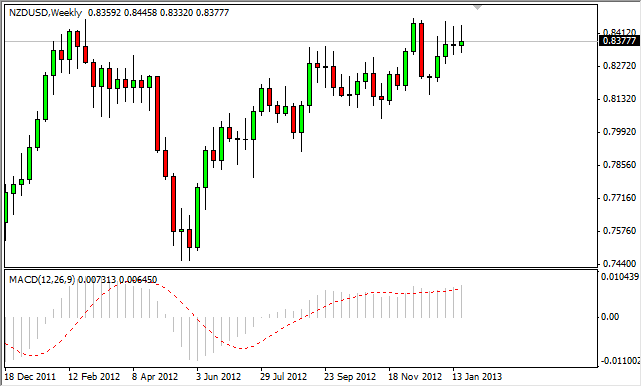

NZD/USD

The NZD/USD pair has done the same thing for the last three weeks: gain for a good part of it, but simply fail to break above the 0.8450 level before falling back down. This price action isn’t “normal” as the equity markets are flying. This pair normally thrives in a “risk on” environment, but isn’t at the moment. Not only is this pair acting poorly in this environment, but so is its cousin across the Tasman, the Aussie. Something isn’t quite right in the commodity currencies, and as a result we should keep our eyes open. I suspect people are starting to lose faith in Chinese economic numbers. In fact, there have been some analysts openly criticizing them lately. The weak price action isn’t enough to start selling yet, but it is something worth watching.

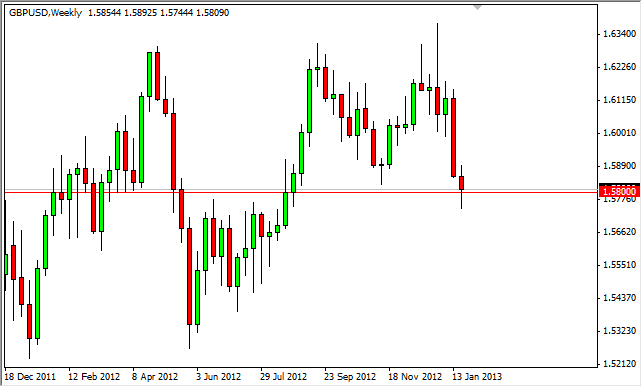

GBP/USD

The GBP/USD spent the week on its back foot. However, there was a bit of a pop on Friday at the 1.58 level, which is major support. This area is where we broke out of the massive ascending triangle this past summer. Because of this, it would make sense to see this pair fight back here. I know there is a lot of talk about a possible “triple dip recession” in the UK, but the technical signals are telling a different story at the moment. If we break above the top of this last week’s candle, I am willing to take a long position to see if we can get back to the 1.63 handle. As for a breakdown, I see too much “noise” below to be bothered with it.