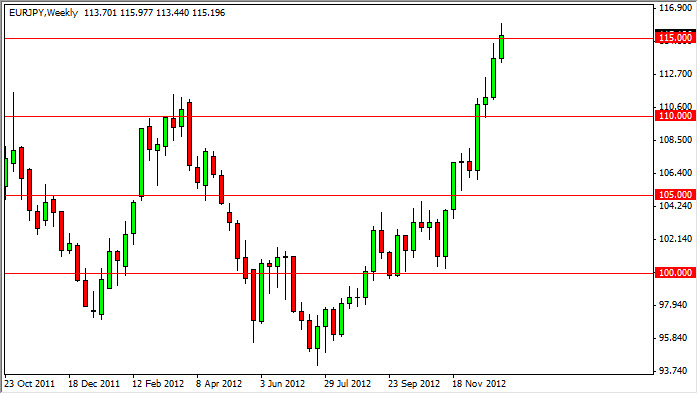

AUD/USD

The AUD/USD pair continues to bounce around between the 1.04 and 1.06 levels. The original consolidation area was between the 1.02 and 1.06 levels, but it appears that the 1.04 is not just the “middle point” now, but the floor. As the consolidation tightens, this normally means that the move is winding up for a breakout. At this point, it looks very much like we are going to see the bulls win out. On a move above 1.06 this pair should reach 1.08, and then the 1.10 level.

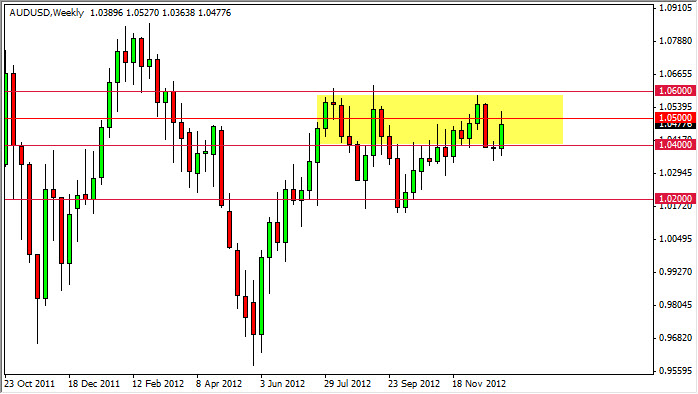

EUR/USD

I am starting to hate this pair. However, it is the most popular pair, so doing analysis without it is a bit tricky. Having said that, the pair should continue to be choppy and trendless as we go into 2013. The pair seems to have found a home between the 1.27 and 1.33 levels, and as you can see from the couple of other lines, there are a few minor areas in between. However, I see no real reason to suspect that we are going to either get a massive solution to the problems in the European Union, or the United States. In others words, this year is going to be a lot like 2012.

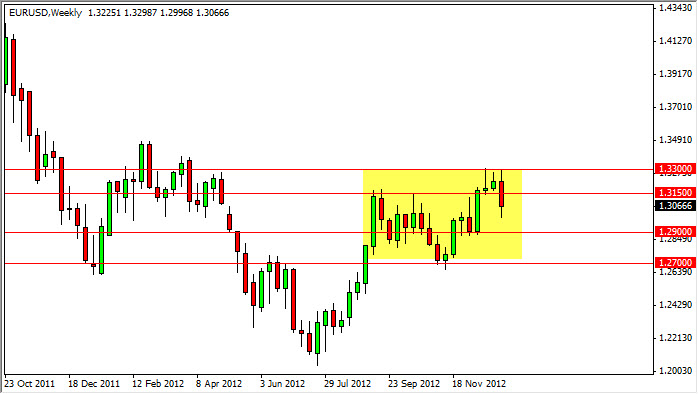

NZD/USD

The NZD/USD pair had an impressive week at one point. However, a bit of those gains were given back, and we now have a nice green candle, but not as nice as it truly could have been. However, this looks like a market that is pulling back so that I can start buying it. In fact, the action on Friday wasn’t bad at all, and I think we should continue to see strength overall, and a run towards the 0.85 level seems likely. A break of that level brings in the idea of 0.90 before too long.

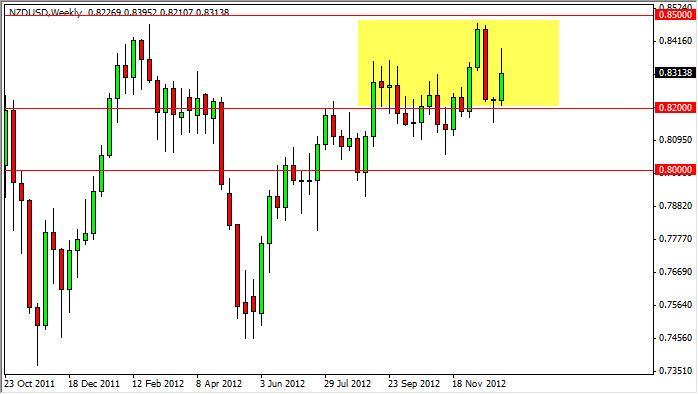

EUR/JPY

The brutality of this move has been impressive. We have slowed a bit at the 115 handle, and this is a good sign to be honest. After all, at this rate we could be at 120 in a week or two – a truly out of control bullish move. In fact we have seen something like 14 handles in just a couple of weeks.

A pullback is needed, and I see a gap on the daily charts at roughly 112. I think this would be a great chance to go long, and this is what I am hoping for this week. I still see the 110 level as being the “floor” in this pair at the moment.