Going into 2013, the Japanese Yen continues to weaken against the USD as the newly elected Prime Minister, Shinzo Abe sends strong signals through recent statements.

First, the Bank of Japan's aggressive monetary policy is aimed at jumpstarting its declining economy although regular easing has further kept the country's balance sheet deeper in deficit. However, BoJ's bold fiscal stimulus has ensured that Japanese exporters are happy through a weak Yen which has revived exports. Secondly, the BoJ has the Prime Minister's unequivocal approval to implement a higher inflation target of 2%. A strong advocate of combating deflation, Mr. Abe has made this a primary policy of his administration and also stated as part of his pre-election campaign that foreign bond purchases will used as a monetary tool in his government. Thirdly, Japan's recent territorial dispute with China has also kept the Yen under pressure due to the fact that China is one of its largest trading partners.

More events ahead for 2013 are Mr. Abe’s choices of the new BoJ Governor and two Deputies. These officials will be key to JPY’s further depreciation due to their influence in BoJ’s Act Amendment and purchases of foreign bonds by the bank.

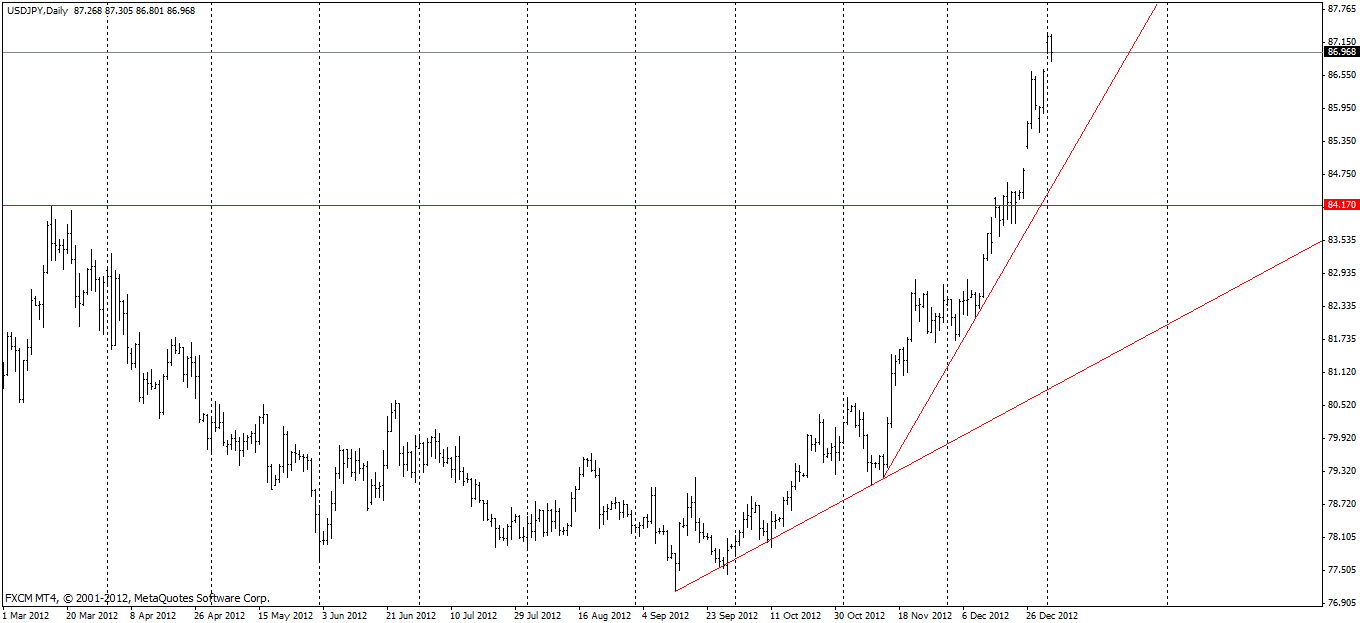

Lately, the just concluded "fiscal bill" deal has sent investors dumping the Yen for USD after much of the positive expectations on the legislation had been priced in as 2012 came to a close. Having reached a historic low rate of ¥76 against the USD back in January 2012, it gradually rose to a little above ¥84 in March. The pair later settled around ¥81 with the BoJ continuing its QE operation; sending the pair to higher rates not seen in over 2 years.

In recent years, the Yen has become one of the easiest currencies to trade based on statements made by the country's public officials. Speaking shortly after his appointment for instance, the new Finance Minister, Mr Taro Aso said for the year 2013, he expects JPY to trade within a price range of ¥85 to ¥90 against the USD.

From a technical viewpoint, USD has been ultra bullish on the daily chart below, so a re-tracement towards the March 15, 2012 resistance-turned-support 84.17 level is expected.

This will provide a better entry after a likely downward break of the bullish trend-line towards the support price. 1st target will be the new resistance level after the pullback, followed by a 6-month target at ¥90 which is also a round number.