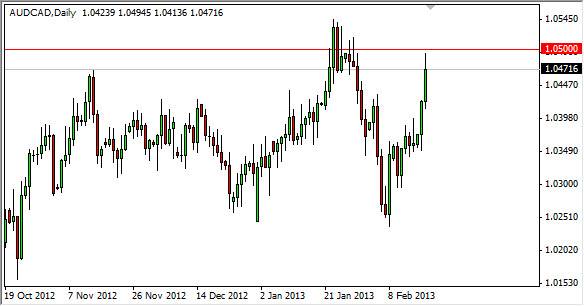

The AUD/CAD pair had a strong showing during the Tuesday session as the market plowed into the 1.05 level. The Canadian dollar found itself on the back foot for most of the session, and the Aussie finally got some relief again some of the major crosses. In this particular scenario, it makes sense that we rose to the 1.05 handle, as it is a significant resistance area.

However, what concerned me about the bullishness of this market is the fact that the 1.05 level is also a very significant long-term resistance point. Because of this, I feel that there could be a shorting opportunity in this general vicinity, especially if you are a shorter-term trader. Alternately, this could be a nice breakout and would be significant if it did in fact happen. However, you have to see a break above the 1.0550 handle, as you can see an area that push price back down in the middle of January.

A battle of commodity currencies

Commodity currencies battling each other always make for an interesting trade. This is because they often run on a lot of the same fundamental issues, and as a result you can really see the real strength of a particular currency in these types of markets. Looking at this chart, it's obvious that the Canadian dollar has been in a bit of trouble against the Aussie for a while. However, we have a very well defined consolidation area between 1.05 and 1.0250 as shown by market action sense early November.

As we are towards the top of this consolidation area, we are possibly looking at a potential sell signal. The four-hour chart shows a shooting star at the 1.05 level, and as a result this could be setting up for a quick drop of 100 or even 200 pips. While I don't generally talk about shorter-term trades, this one is fairly obvious to me, and it also coincides nicely with both the AUD/USD pair running into resistance, which of course means that the Australian dollar should fall slightly, and the USD/CAD pair forming a shooting star, suggesting that the Canadian dollar is about to pick up strength as well. In other words, this pair should start falling.