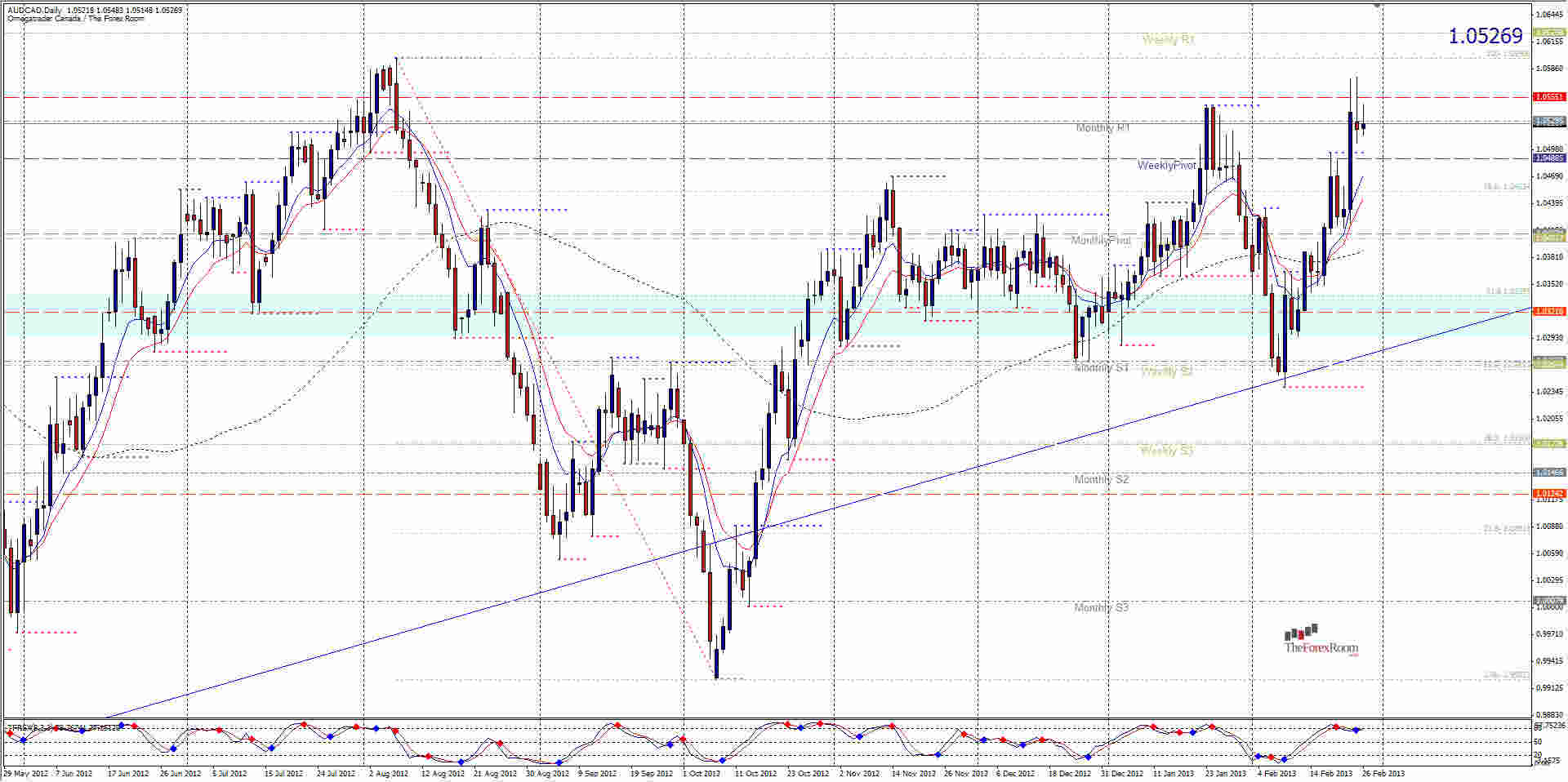

The AUD/CAD printed a Pin Bar Reversal at the resistance level surrounding 1.0550 yesterday. The pair has been trading in a pretty well defined horizontal channel since around March of 2011. Lows ranging from 0.9916 to 0.9955 define the floor while highs are pretty consistent between 1.0529 and 1.0598 with a few exceptions here and there. Last week the pair reached a high of 1.0579 before pulling back to close below the January high of 1.0546. The pair once again attempted to close above 1.0550 but failed and the results was a Bearish Pin Bar on the Daily Chart. This makes something of a double top on the Daily Chart as well with January highs making the first attempt and failing. At that time, prices fell some 300 pips to 1.0240 on February 11 before reversing at the Monthly S1/Weekly S2, which happen to be the October 2012 highs as well. There is a pretty strong possibility we should see the same thing happen again to some extent if yesterday's low is broken at 1.0505 but there is support at 1.0490 to contend with. Alternatively, if the high is broken at 1.0578, look for resistance again at the August 2012 highs of 1.0598 and October 30, 2012 highs of 1.0665 will be the next target.

AUD/CAD Rejecting 1.0550?

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- AUD/CAD