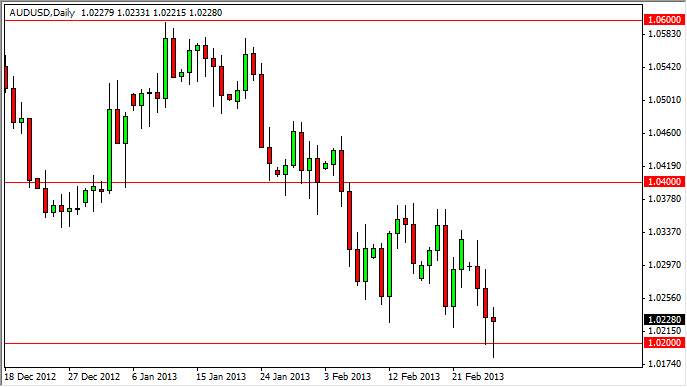

The AUD/USD pair fell and broke below the 1.02 level on Wednesday, only to bounce back and show support in the general vicinity. The resulting daily candle formed a hammer, which of course shows significant support and is one of my favorite bullish signals. Because of this, I think that the Australian dollar will put in a bit of a fight now, and we could return to the previous consolidation area which would have this market looking for the 1.03750 level.

Looking forward, you have to keep in mind that there is a greater consolidation area at play as well. We have been watching this market bounce around between 1.02 and 1.06 for several months now, and we are presently at the lows of this greater trading range. Because of this, it makes sense to look for buying opportunities here.

Risk on, risk off

The Australian dollar gets used as a vehicle to express risk appetite by currency traders around the world. It is because of this that we will have to pay attention to how the general market attitude is in order to trade this currency. The Australian dollar itself is a plan commodities and Asian growth quite often, and as a result we need to pay attention to China and the rest of Asia as well.

It does get a bit convoluted at times, but this is mainly because the Australian supply the ages was so much of their raw materials. If the markets are feeling "happy", the Australian dollar almost always rises. I believe that this market will grind higher over the longer term, and it really wouldn't surprise me to see a move up to the 1.06 level as well. If we have that move however, we could have a bumpy ride all the way up there. Because of this, if you do decide to take a buy signal on a break above the hammer for Wednesday, you have to be willing to acknowledge this, and plan your trade accordingly. If you are trying to play the longer term consolidation area like I am thinking of, you have to be willing to stomach a lot of volatility between here and there. Alternately, if we do break down below the lows of the hammer on Wednesday, I think we will try to find parity.