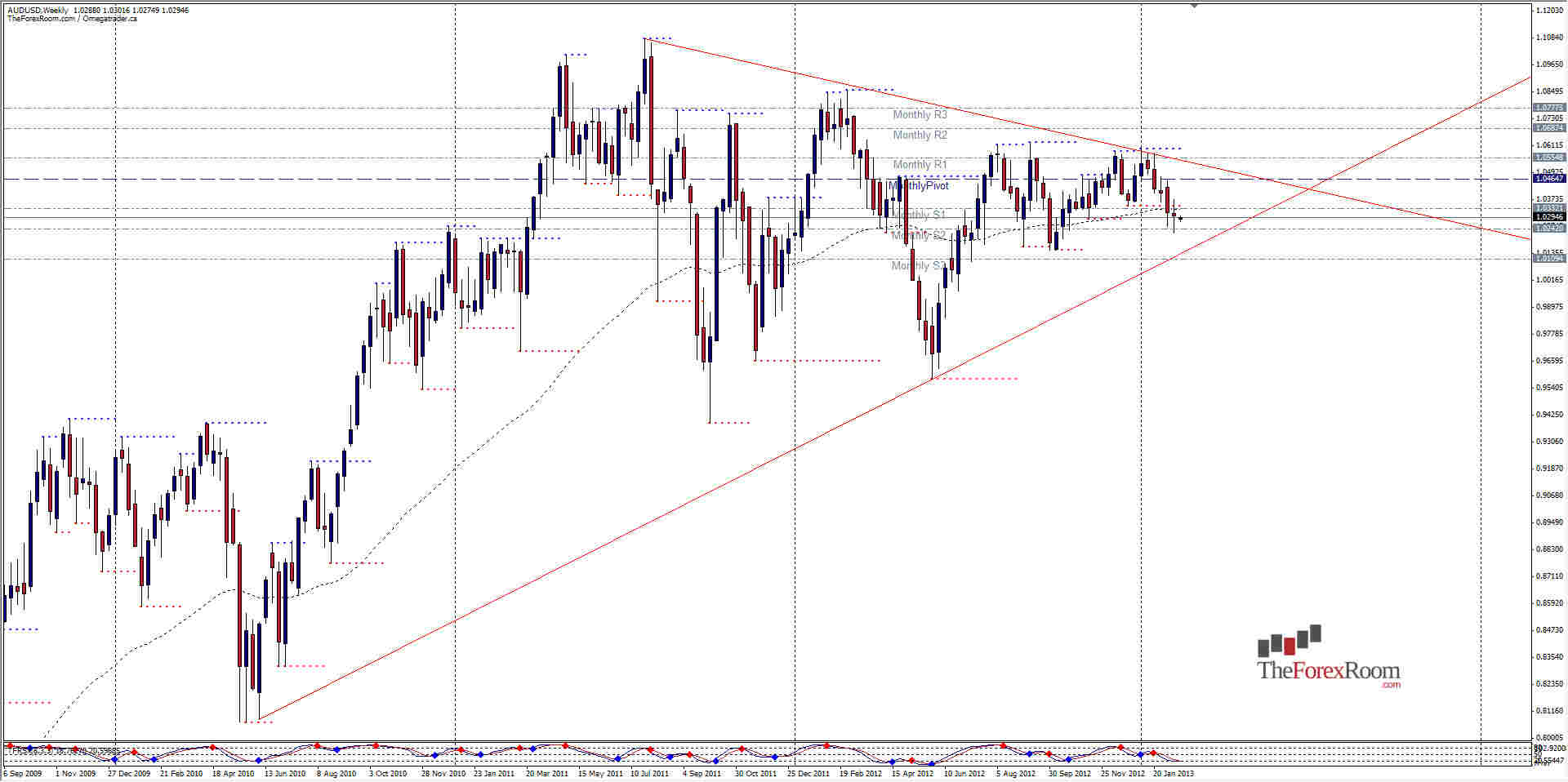

The AUD/USD is trying very hard to give up the support level at 1.0225 established last week. If we look at the weekly chart we see that the upper descending trend line is holding true to form, while the downside still has some bearish potential to at least 1.0149, the low from October 14, 2012 as well as the intersecting point for the rising trend line and the Monthly S3. If this area falls, there is a massive technical vacuum down to at least 0.9580, and possibly 0.9380 which was the high in 2008. On a daily chart we see that price has retouched the previous support level at 1.0375 and fallen away with a hanging man formation printing on Thursday followed by a bearish engulfing candle on Friday that halted its decent at 1.02875, the high from October 08, 2012. Should this level break we will be testing the 1.0225 level almost certainly, and I suspect the area will not hold back the bears this time. But, if prices do hold, and we push back upwards, look for resistance at 1.0300, 1.0330 and of course 1.0375.

AUD/USD Outlook Remains Bearish

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- AUD/USD