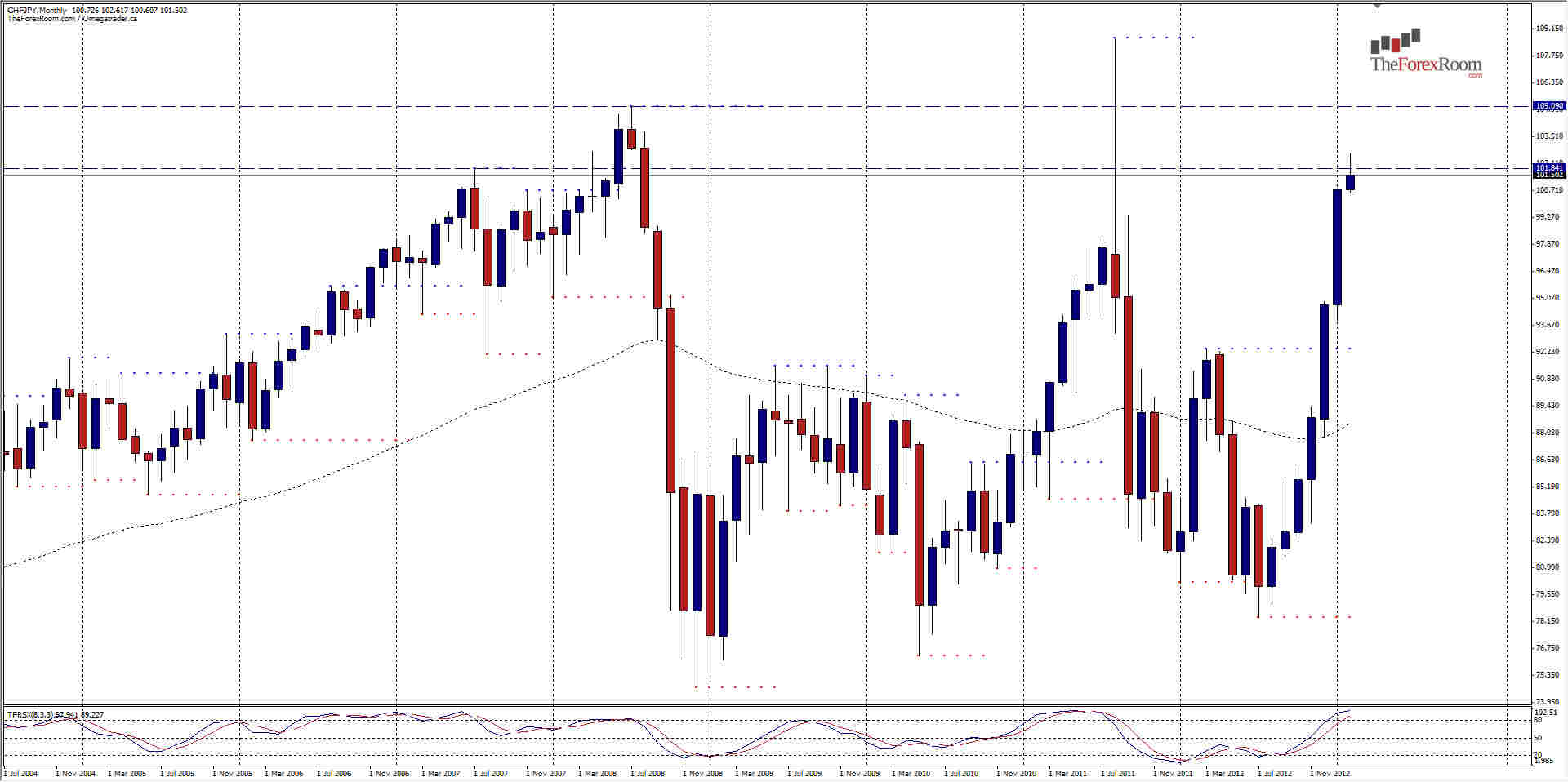

The CHF/JPY cleared the 1998 high last week at 100.85 with little effort and continued on to the 2007 highs at 101.84 before stalling at 102.62 and forming an 'Inside Bar' on the daily chart yesterday. This is a Bullish Continuation Pattern and could indicate that the pair is far from ready to perform any serious form of correction just yet, but only time will tell. A break of Friday's high will probably see a push towards the 2009 high at 105.09 before hitting the 2011 high at 108.702. Beyond that level the sky really is the limit, because we have not traded higher than 108.702 in the last 22 years! Price has pulled back a little further since the New York session ended on Monday, to be trading currently at 101.488, so there might indeed be a further correction in store. But allot of traders are familiar with the 'Sell Monday, Buy Tuesday' phenomenon and the bulls could pick up where they left off during either the next London or most likely the New York session. If the bears remain in control for awhile, look for support at 100.775 (Thursday's high & Weekly Pivot)...if we get a deeper pull back I'll be watching the 98.50 area closely for a bounce. To the upside we will need to clear last week's high of course, which is 102.62 but there will be little actual resistance until we reach the previously mentioned 105.09, so we can turn to Pivot levels for pause points, such as the Weekly R1 at 103.98.

CHF/JPY Testing 2007 Highs

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- CHF/JPY